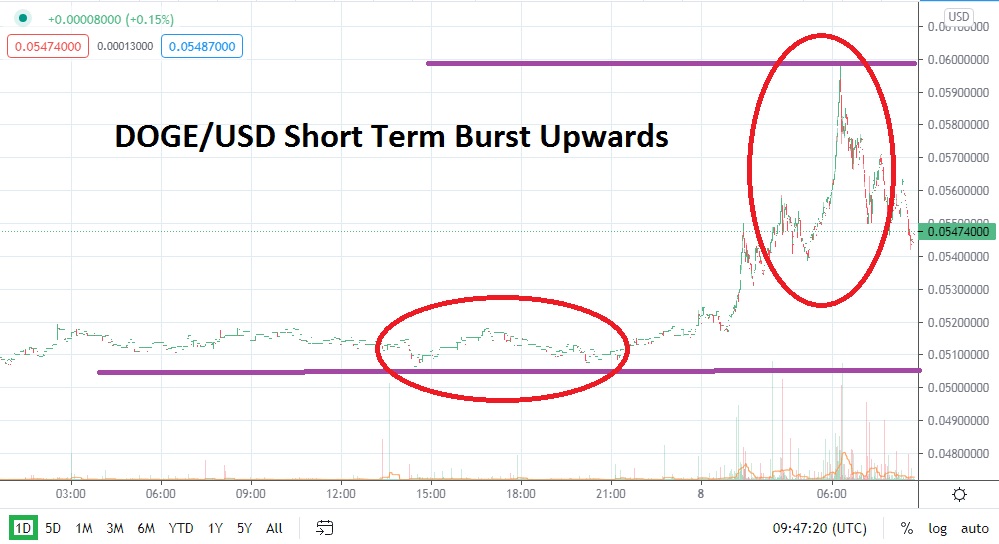

DOGE/USD experienced a strong move higher late last night and early today as it likely benefited from a positive wave of sentiment being generated in the broad cryptocurrencies. DOGE/USD actually approached the six cents mark early today, before it saw a decline in value and it is now traversing below five and half cents. However, the current price of DOGE/USD is well above its trading band which has been seen the past five days.

On the 5th of March DOGE/USD was trading below the five cents juncture and it climb above this ratio the past couple of days has happened as Bitcoin, Ethereum and other cryptocurrencies have seen buying build too. Today’s surge higher for Dogecoin saw its test values not traversed since February the 24th, when DOGE/USD was able to trade above the six cents level.

This morning’s quick pullback in price illustrated the difficult path DOGE/USD has had when trying to trade above the six cents level since the middle of February. It should be noted by technical traders that DOGE/USD was able to sustain its price above the six cents juncture from the 7th until the 15th of February on a solid basis. The high of nearly nine cents achieved on the 7th of February was short lived, and since then DOGE/USD has essentially been on a downward path.

As DOGE/USD trades between five and six cents it will remain an interesting speculative asset for traders. The five and half cents juncture should be looked at carefully by traders. After achieving its strong move upwards in the past twelve hours DOGE/USD is once again below five and half cents. The last time DOGE/USD sustained its trading with durability above the five and half cents ratio was between the 18th and 25th of February.

Today’s trading in DOGE/USD could prove to be important short term. The positive sentiment which has been seen in the broad cryptocurrency market has certainly put wind in the sail of buyers the past day for Dogecoin.

If upwards momentum can continue to be established in the broad cryptocurrency market there is reason to believe DOGE/USD can challenge nearby resistance levels. Traders tempted to buy DOGE/USD at its current values should use limit orders and have their take profit positions working to cash out of what could potentially be a quick market with violent reversals abruptly happening.

Dogecoin Short Term Outlook:

Current Resistance: 0.05700000

Current Support: 0.05380000

High Target: 0.05980000

Low Target: 0.05200000