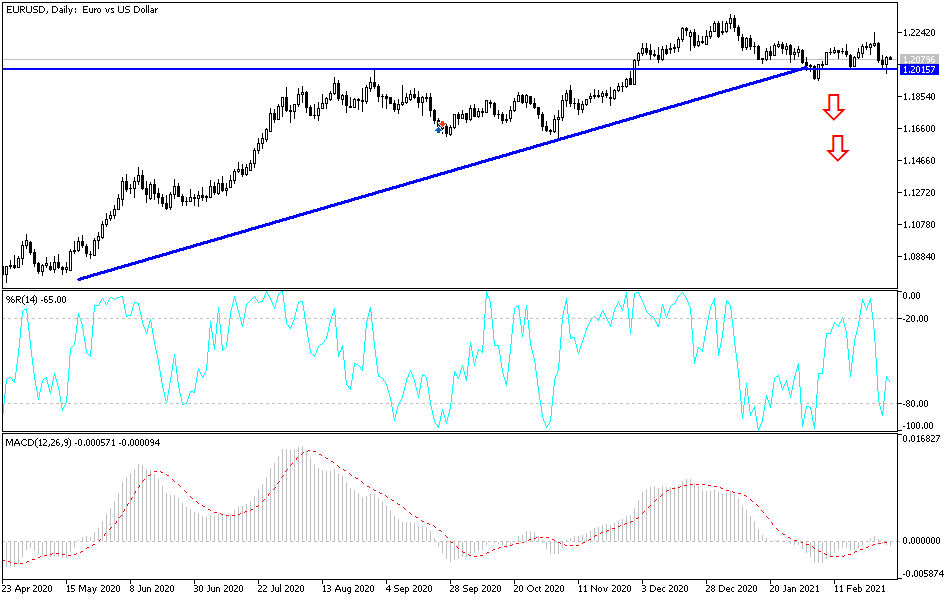

The euro fell to the 1.20 level only to turn around and rally during the trading session. The market is trying to continue the overall uptrend, and I do think that the 1.20 level will continue to be an area that a lot of people will pay attention to, as it is a large, round, psychologically significant figure and an area where we have seen buying recently. The market has been in a range for a while, and I think that will continue to be the case. After all, we do not have anything driving the market longer term currently, as we are essentially in a 300-point range.

The support level at 1.20 extends down to the 1.19 level, so I think that it is going to be difficult to break down below there. If we did, it would be a huge sign of weakness, but we have seen quite a bit of a bounce back during the trading session to suggest that perhaps the market is not quite ready to make a bigger move. After all, the European Union has a lot of issues when it comes to inoculations and lockdowns. On the other side of the Atlantic Ocean, the United States is starting to put up large figures when it comes to manufacturing and the like.

Beyond that, it is likely that the United States may get “herd immunity” much quicker than other major economies, so at this point it does make sense that, at least from the coronavirus standpoint, that the United States is stronger than the EU. Furthermore, we have seen interest rates in the United States rally until the last couple of days, so if we see that continue to happen then the US dollar will almost certainly strengthen. However, the market right now is trying to decide whether or not we can build up enough momentum in order to break above that 1.23 level. Between the 1.23 and the 1.25 level there is a lot of resistance as well, so I think we have a lot of choppy sideways action in this 300-point range for the foreseeable future. Furthermore, the 50-day EMA is sideways right now as well, so essentially it means that we have nowhere to be in the short term.