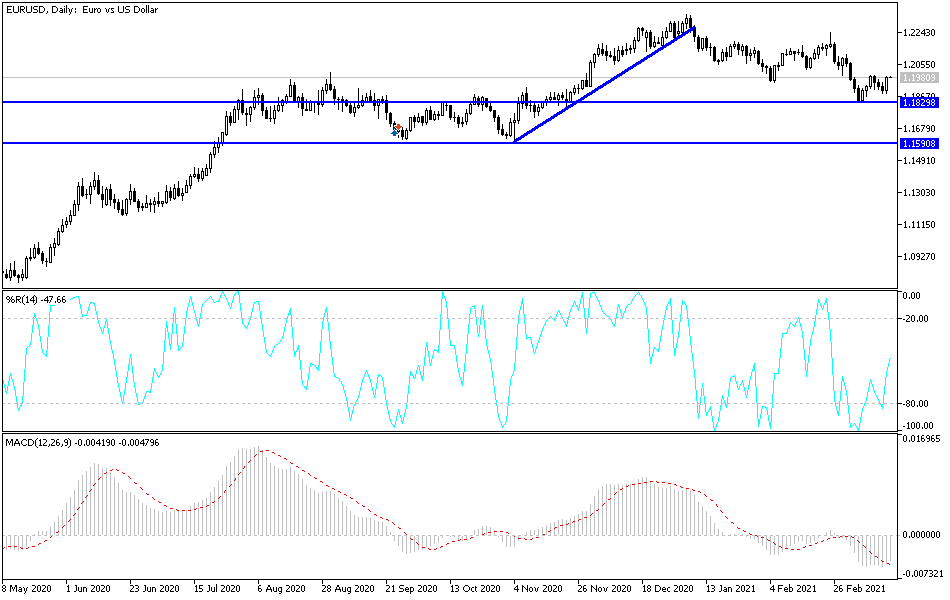

The euro rallied a bit during the trading session on Wednesday again as we have shown further US dollar weakness after the FOMC meeting. It now looks as if we are going to go looking towards the 1.20 level. That is an area that has been crucial more than once, and I think would set up a nice fight. If we can break above that level, then it is likely that the euro will continue to rally significantly. Furthermore, the 50-day EMA sits just above so I think that comes into play as well.

If we can break above the 50-day EMA, it is likely that the market then goes looking towards the 1.22 level, which is an area where we have seen a lot of selling from previously. If we get there, then it could open up a retest of the recent highs that we had seen on the weekly charts that had repelled the euro so drastically. The 1.23 level is an area that I think will demand a lot of strength to get through, so it is probably going to take multiple attempts. Furthermore, we have to pay attention to the 10-year note and the rest of the bond yield curve that is so influential when it comes to the greenback.

The uptrend line underneath is massive support that extends going forward, and it is also worth noting that the 1.19 level also looks important as well. In fact, what is truly interesting about this is that the market had bounced directly from the 200-day EMA, which a lot of longer-term traders will pay close attention to. In general, I think that short-term pullbacks will be bought into unless of course we get down below the 200-day EMA, which would open up a mass flood of selling. However, at looks as if the overall uptrend is still very much intact, even though we have seen a lot of noise as of late. Once traders relax about the bond market, that should continue the move higher in some of the other “risk-on” currencies, such as the euro and others. If we can break above the 1.20 level, it is very likely that we will see more of an acceleration in the current.