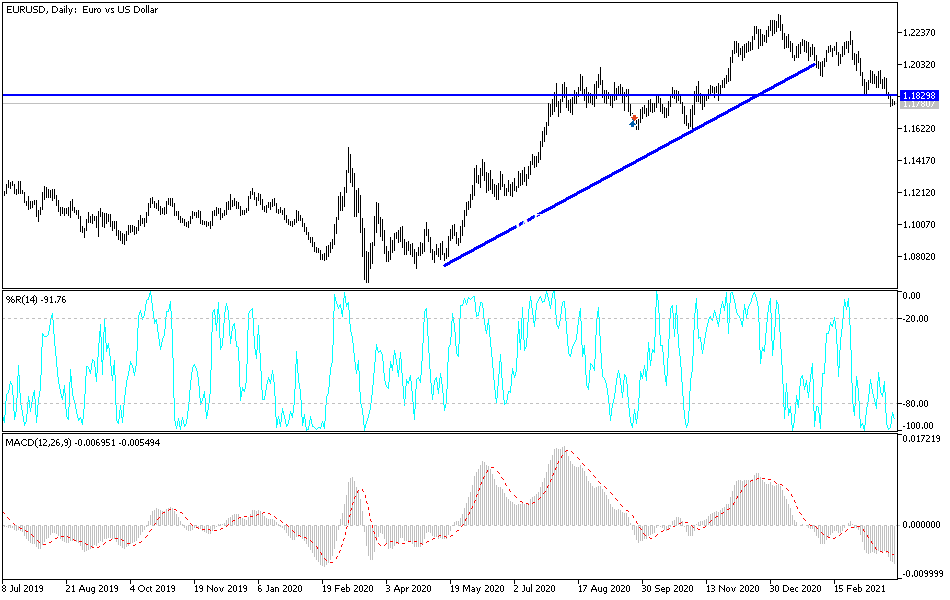

The euro rallied just a bit during the trading session on Friday, but still remains well below the 200-day EMA. Because of this, I believe that the euro will continue to struggle to rally, as we have a lot of trouble in the European Union with massive lockdowns and the next wave of the coronavirus causing major issues. Furthermore, the yield differential between Germany and America continues to widen, and as long as that is going to be the case, we are likely to see this market fall as traders will look to the US dollar as being the favorable currency.

The 200-day EMA is an indicator that a lot of people pay attention to in order to determine what the longer-term trend is. Regardless, we have broken through that level and the uptrend line that I have marked on the chart. This tells me that we are very likely to go looking towards the 1.16 level underneath, where the next major support level is found. The 1.16 level would be important, and if we break down below it then the market could drop yet another 400 pips before it is all said and done.

If we were to turn around and break above the 200-day EMA, then it is likely that we will go looking towards the 1.19 level above. That also meets up with the previous uptrend line, so that is a barrier that I think is going to be difficult to get beyond. However, if we did, then the euro very likely will go looking towards the one point to zero level next, as it is a large, round, psychologically significant figure and where we see the 50-day EMA currently hanging about.

One thing that I do think we are going to see a lot of is volatility, so you are going to need to keep an eye on your position size, and perhaps trade from shorter-term charts. I still have a negative bias, so with that being the case I like the idea of looking for spikes on something like a 15-minute chart to continue fading. As far as holding onto positions is concerned, I would have to see a bigger candlestick to be convinced to put serious money to work.