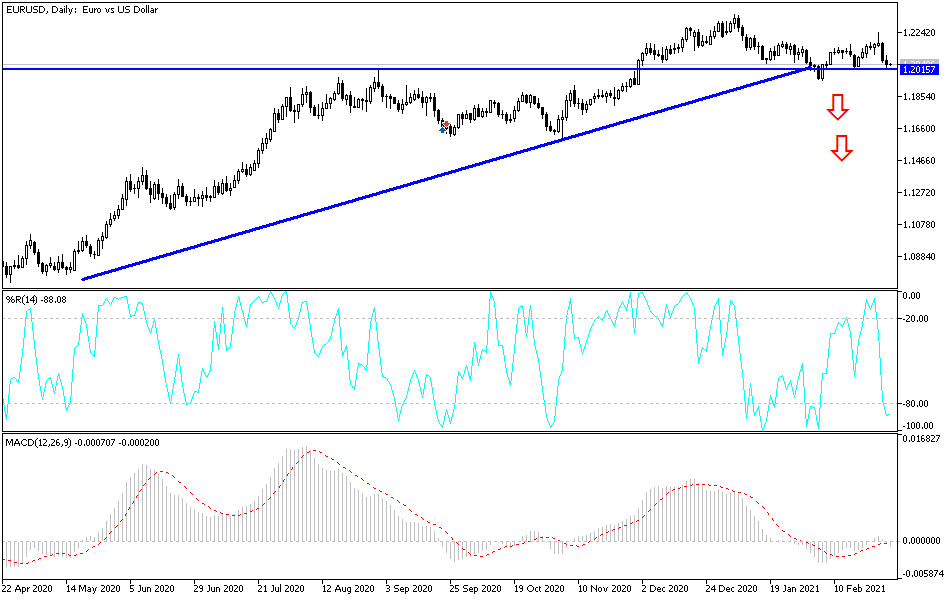

The euro initially tried to rally to retake the 50-day EMA on Monday but gave back the gains to turn around and press towards the 1.20 level. That is an area that should be supportive extending down to the 1.19 level, so I think it is going to be a bit difficult to slice through it. However, with yields in the United States rising, it certainly does favor the US dollar over the euro, and that may be a lot of what we are seeing at the moment.

The 50-day EMA is relatively flat, which suggests that we are in a sideways movement, and I think it could keep the market relatively choppy over the next several days. Furthermore, the Friday session features the non-farm payroll numbers, which often will keep the markets quiet heading into it. We also have several Federal Reserve officials speaking during the week, so all of this sets up for a choppy and sideways market until we get a little bit of clarity.

If we do break above the 1.22 level, then it opens up a move towards 1.23 handle. On the other hand, if we were to break down below the 1.20 level, the support level extends down to the 1.19 handle, so we really need to break down below there to do serious structural damage to the euro. This is a market that is going back and forth based upon US yields, anticipation of the jobs number, and the latest numbers coming out of the European Union. On the bearish case, the European Union is suffering at the hands of rolling lockdowns and a sluggish vaccination program, so I think the euro is probably going to struggle a bit in this area to show any real determination to go one direction or the other. So if you are a short-term range-bound type of trader, this might be the perfect pair for you this month. Sooner or later though, we will make an impulsive move, one that we can follow. Right now, I just do not see it, but I will be paying close attention to the 1.19 level if we do break down below it. That would more than likely coincide with a lot of US dollar strength around the world.