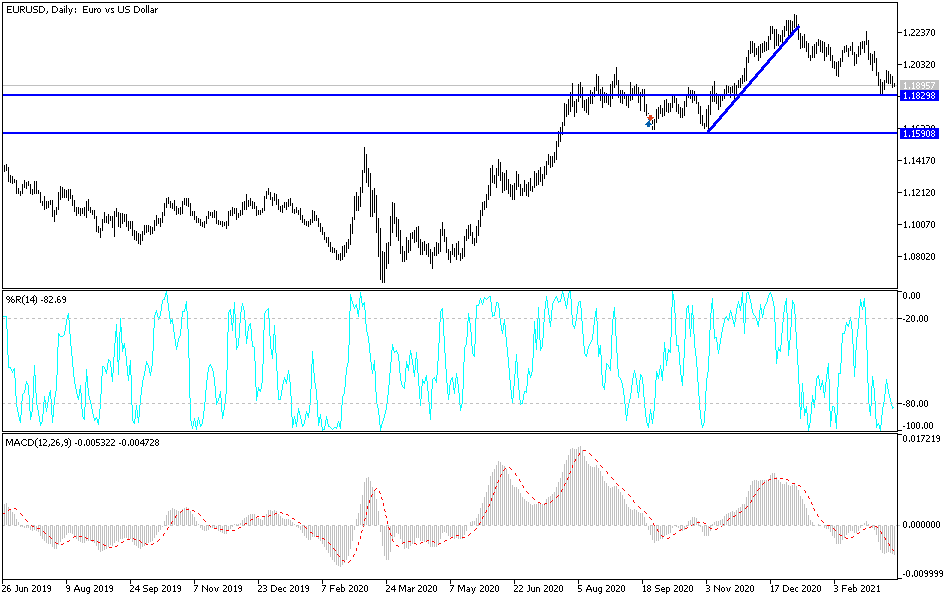

The euro fluctuated during the course of the trading session on Tuesday as we continue to see the 1.19 level offer a little bit of support. What is interesting is that we have a trendline here, but I think even more important is the fact that recently we have bounced from the 200-day EMA. By doing so, it does save the long-term trend to the upside, at least from a theoretical standpoint. This is a market that is trying to hang on to the overall uptrend, and it is likely that we will see some type of major reaction to the FOMC meeting.

After all, one of the biggest conversations right now is whether or not the yield in the Treasuries will calm down in America. That has been a major issue with US dollar strength causing a bit of a headache for risk appetite. I like the idea of waiting until after Jerome Powell speaks after the FOMC meeting, giving us an idea as to whether or not the bond yields will be dealt with. If they can drive those yields down or at least give the market the impression that they are going to, then it is likely that we would see the euro be one of the big beneficiaries. By the time we get done with the Wednesday session we should have an idea as to where this pair wiill go. Breaking down below the uptrend line could send this this market all the way down to the 1.16 level over the longer term.

On the other hand, if we turn around and break above the 1.20 level, that could kick off the next leg higher, which could send this market as high as the 1.23 level given enough time. The size of the candlestick does suggest that there is a little bit of confusion, which is quite typical a day ahead of the FOMC, especially as we have so many different crosswinds going on at the same time. The choppiness will probably continue, but by the end of the day Wednesday hopefully Jerome Powell would have given us a little bit of clarity when it comes to the central bank in the United States, which is a major move forward.