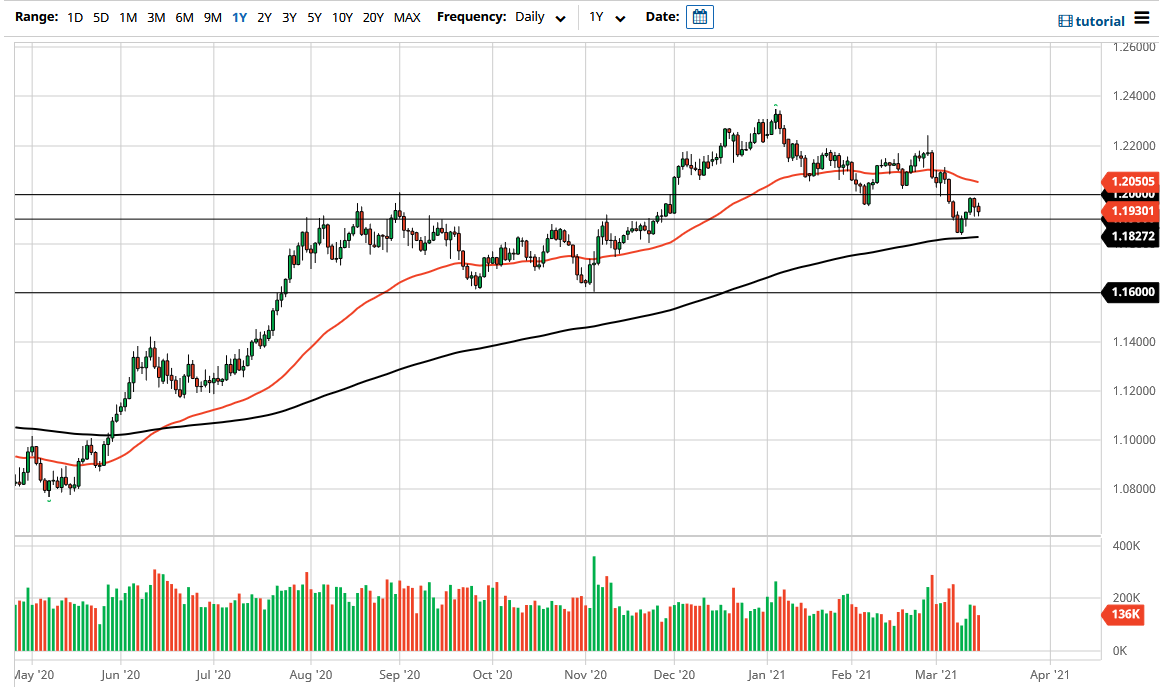

The Euro has fallen just a bit during the trading session on Monday to reach down towards the 1.19 handle before bouncing. However, we are essentially stuck between the 1.19 region and the 1.20 level. At this point, I think a lot of what we are seeing here is a market that does not know what to do next, because we need to see what the United States is going to do about yields. Recently, yields have spiked in the bond market, and with a FOMC meeting on Wednesday as traders keeping an eye on what Jerome Powell has to say about the recent spike in yields.

If he says nothing or very little about it, it could continue to strengthen the US dollar. By its very nature, that will drive this pair down as the Euro is considered to be the “anti-dollar.” Nonetheless, if we break down below the bottom of the candlesticks from last week, then it opens up even more selling, perhaps sending the market down towards the 1.16 level. After all, that would be especially likely if we continue to see yields spike in the United States. That makes bonds much more attractive, which of course are funded in US dollars. Alternately, if we see the yields fall in America, and Jerome Powell does in fact suggest that the Federal Reserve is keeping an eye on it, then it is possible that we would see the US dollar lose strength, thereby pushing the Euro higher.

Between now and then, I would anticipate a lot of noise, as the markets are simply going to be killing time between now and then. The 50 day EMA is sitting just above and slightly lower, but the 200 day EMA is starting to rise, and we did in fact bounce from that indicator. All things being equal, I think that this is an area that we are going to continue to see a lot of choppy behavior back, and I think by the end of the week we should have quite a bit more in the way of clarity when it comes to this pair. Ultimately, I think you need to be patient if you are looking for a bigger move, but if you are a short-term day trader, you probably will be able to look at this as a potential area to trade.