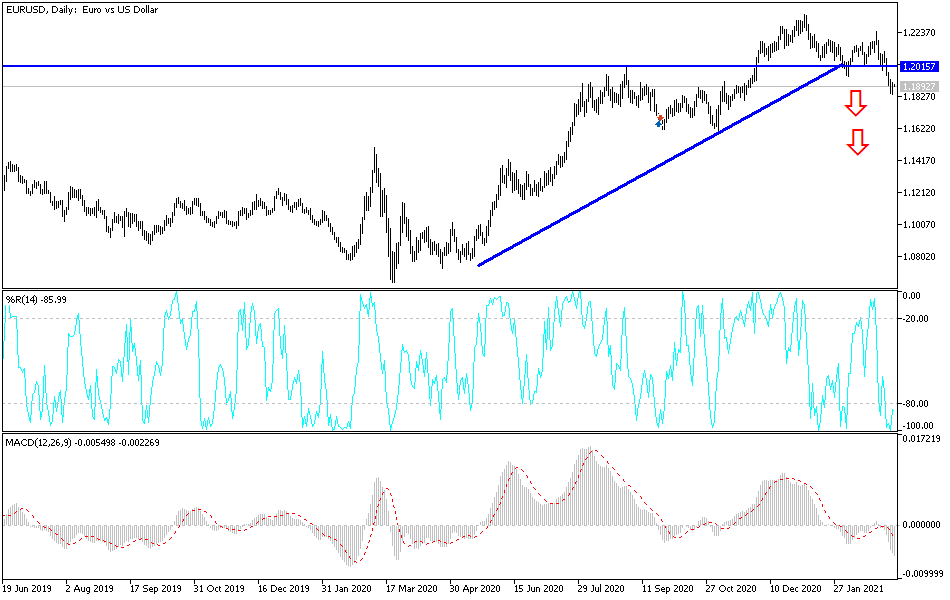

Bearish View

Sell the EUR/USD anywhere below 1.1925 (descending trendline).

Add a take-profit at 1.1832 and a stop-loss at 1.1952.

Timeline: 1-2 weeks.

Bullish View

Set a buy stop at 1.1925 and a take-profit at 1.200.

Set a stop loss at 1.1835.

The EUR/USD price retreated in the American and Asian sessions as traders waited for the important US inflation data and the European Central Bank (ECB) decision.

US Inflation Ahead

The Bureau of Statistics will publish the latest US Consumer Price Index (CPI) data in the afternoon session today. In general, economists believe that US inflation increased in February as the vaccination process continued. The impacts of the $900 billion stimulus passed in January, the reopening process, and higher crude oil prices also helped boost prices.

In general, according to a survey by Bloomberg, the median estimate is that the CPI increased from 1.4% in January to 1.8% in February. If this happens, it means that the CPI is just 0.2% below the Fed’s target of 2%. It also means that inflation will continue to accelerate as the US prepares for another $1.9 trillion stimulus package. The median estimate is for the core CPI to rise by 1.5%.

Higher inflation could be bearish for the EUR/USD because it would mean that the Federal Reserve will be forced to start tapering its asset purchases earlier than expected. It would also push the yield of US Treasuries higher.

The EUR/USD is also falling as the ECB officials convene to deliberate on the Eurozone’s economy. With the economy recovering, analysts expect that the bank will leave its interest rate unchanged tomorrow. It will also leave the ceiling of its asset purchases unchanged in a bid to support the economy.

EUR/USD TechnicalSsignal

The EUR/USD price has been on a steep downward trend in the past few weeks as the yields of US bonds has risen. It has dropped by more than 3.3% in the past two weeks. On the two-hour chart, the price is below the Ichimoku cloud, which is a bearish thing. It has also moved below the descending trendline that connects the highest levels since February 25.

The downward trend is also being supported by the short and medium-term moving averages. Notably, the two lines of the Stochastic oscillator have started to make a bearish crossover. Therefore, in my view, the pair will resume the downward trend as bulls retest this week’s low at 1.1833.