Last Thursday’s EUR/USD signals were not triggered, as there was no bullish price action when the price first reached the support level identified at 1.2028 that day.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be taken between 8am and 5pm London time today only.

Short Trade Ideas

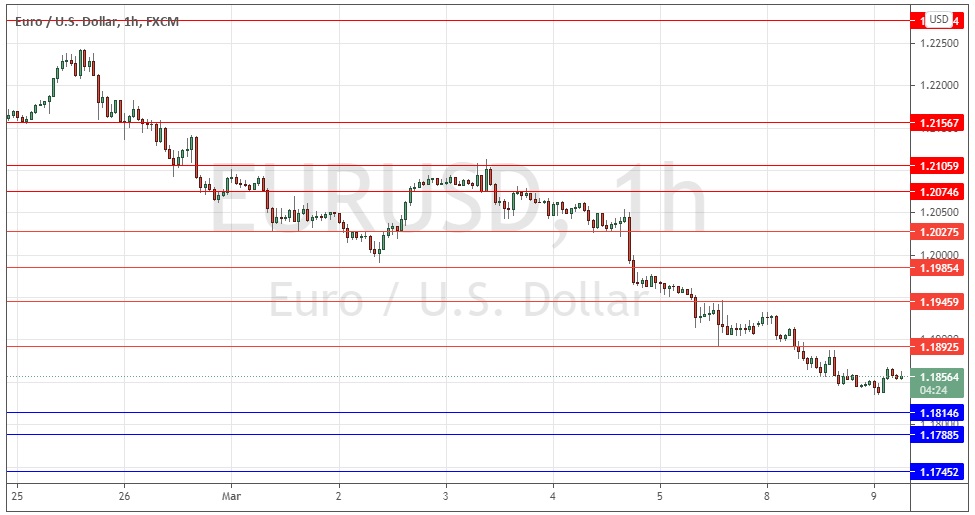

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1893, 1.1946, or 1.1985.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1815, 1.1789, or 1.1745.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that this currency pair was in an aimless consolidation on both short- and long-term time frames. The most useful thing I could think of saying was that the support level at 1.2028 looked strong, as I thought also did the resistance levels which I had identified at 1.2075 and 1.2106. This was not a useful call, but it was enough to keep out of trouble.

The technical picture now is much more bearish, as the U.S. dollar has continued to advance firmly while the euro has become one of the weakest major currencies.

We have seen a very significant development over the past few days: the price has finally broken down below the pivotal area I identified last week at 1.1950 to get established at a new multi-month low price. When this happens in the EUR/USD currency pair, it is usually a signal that the trend is more likely than not to continue, so being short of this currency pair has been and continues to be a good idea.

Swing or position trading the EUR/USD for best results usually involves trying to enter on pullbacks rather than breakouts for best results. Therefore, it will probably be wise to wait for a retracement to one of the key resistance levels and a bearish reversal there back into the trend before entering any new short trades. Or at least waiting for a bearish turn in the price action on the hourly chart even if the price never quite makes it as high as 1.1893.

There is nothing of high importance concerning either the EUR or the USD.