Bearish Signal

Set a sell stop at 1.1835 (overnight low).

Add a take profit at 1.1760 and a stop loss at 1.1880 (neckline of double top).

Timeline: 1-2 days.

Bullish Signal

Set a buy stop at 1.1880 and a take-profit at 1.1950.

Set a stop loss at 1.1840.

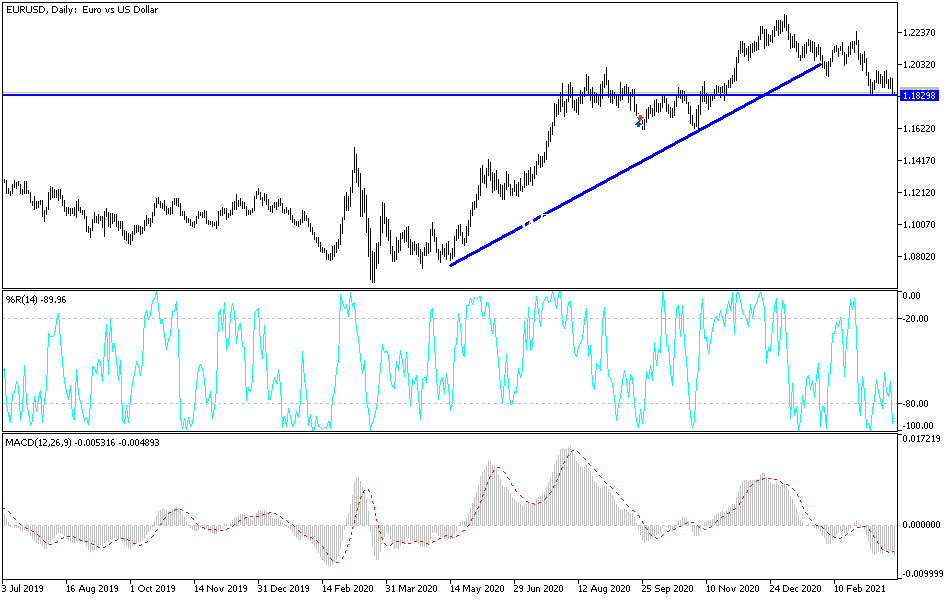

The EUR/USD price dropped to the important support at 1.1835 as the market reflected on Jerome Powell and Janet Yellen’s testimony in Congress. It is trading at 1.1847, which is 1.20% below the double top level of 1.1989.

Yellen and Powell Testimony

In testimony before a congressional committee, the Fed chair and the Treasury secretary talked about the state of the American economy. In his remarks, Powell said that the Fed had done well to cushion the economy during the pandemic. He also reiterated that the ongoing recovery was uneven, meaning that more support will be needed.

In her remarks, Yellen said that the country will need some tax hikes to fund the proposed $3 trillion spending package being worked on by the administration. The administration has said that it will increase taxes for all people earning $400,000 per year. It will also hike the corporate tax from the current 21% to 28% and close the loopholes that help firms avoid paying taxes. The two leaders will continue testifying today.

Looking at the economic calendar, there will be several key events that will move the EUR/USD today. First, Markit, the research firm, will publish the latest flash Manufacturing and Services PMI numbers from key countries.

In Europe, analysts expect the Manufacturing PMI to drop from 57.9 in February to 57.7 in March while Services PMI increased from 45.7 to 46.0. In the US, they expect that the Manufacturing PMI rose from 58.6 to 59.3 while the Services PMI rose from 59.8 to 60 as the country continued to reopen. The US statistics agency will also publish the latest durable goods order numbers. Core durable goods are expected to fall from 1.3% to 0.6% while the headline durable goods are expected to fall from 3.4% to 0.8% in February.

EUR/USD Technical Forecast

On the four-hour chart, we see that the EUR/USD formed a double-top pattern at 1.1989 in the past few weeks. This week, it moved below the neckline of this pattern at 1.1880. Overnight, it reached to the support at 1.1835, which was the previous lowest level this year. The 15-day and 25-day EMAs have also made a bearish crossover while the Relative Strength Index (RSI) has moved to below 40. Therefore, the pair may continue falling as bears attempt to move below 1.1800.