Bullish View

Set a buy stop at 1.2095 (yesterday’s high).

Add a take profit at 1.2150 and a stop loss at 1.2050.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.2065 and a take-profit at 1.2000.

Add a stop loss at 1.2100.

The EUR/USD price rose in the overnight session ahead of the important Service PMI numbers and the ADP non-farm payroll numbers. It is trading at 1.2083, which is 0.80% above last week’s low of 1.1990.

Eurozone and US Service PMI Ahead

On Monday, data by Markit and the Institute of Supply Management (ISM) published the relatively strong Manufacturing PMI data. In the US and Europe, the PMI figures were above 50, which is a sign that business activity continued to do well.

Today, the two organizations will publish the important Service PMI figures. These numbers are usually more important because the service sector is the biggest employer in Europe and the United States.

Economists surveyed by Reuters expect that the European Service PMI increased to 44.7 in February. In Germany, they see it rising to 45.9 while in Italy and France, they expect the figures to come in at 46.0 and 43.6, respectively. In general, the services sector has underperformed because many service providers were deemed non-essential.

Later today, the EUR/USD will react to the latest Service PMI data from the US. Analysts expect that the Markit PMI will come in at 58.8 while the Institute of Supply Management (ISM) will come in at 58.7.

Meanwhile, ADP will publish the latest non-farm employment change data that will provide a snapshot of the state of the economy. Analysts predict that the private sector added 177,000 jobs in February after adding another 174,000 in the previous month. These numbers will come approximately two days before the official US non-farm payroll numbers.

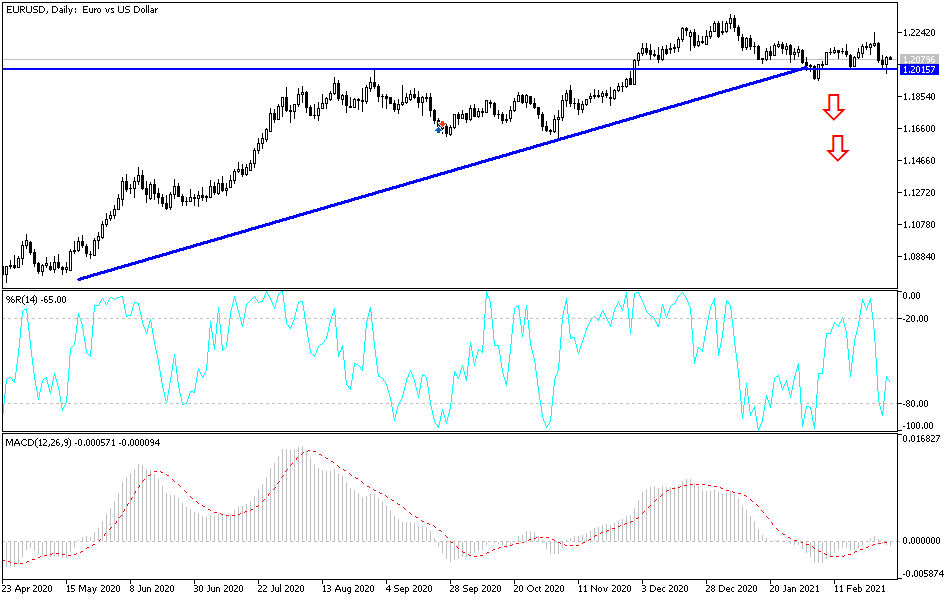

EUR/USD Technical Outlook

The two-hour chart shows that the EUR/USD pair has been in a strong upward trend in the past few sessions. It is trading at 1.2085, which is slightly above yesterday’s low of 1.1990. The pair has consolidated in the past few trading sessions and is slightly above the 25-period and 15-period weighted moving averages (WMA).

The pair also seems to be forming a head and shoulders pattern. Most importantly, it has formed a bullish consolidation pattern. Therefore, the pair will likely continue rising as it tries to complete the right shoulder.