Today’s EUR/USD Signals

Risk 0.75%.

Trades must be taken prior to 5pm London time today only.

Short Trade Ideas

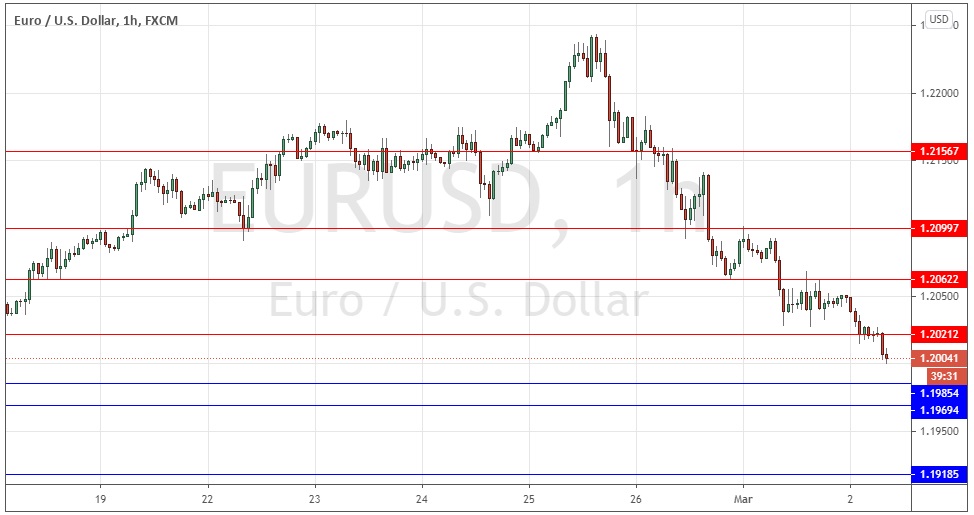

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2021 or 1.2062.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1985, 1.1969, or 1.1919.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

After rising strongly to make a new 2.5-year high price only a few weeks ago at the start of this calendar year, the price has moved down quite firmly, and is now close to making a new multi-month low.

This currency pair is worth paying attention to for several reasons: its proven historical propensity to trend steadily (making profitable trading easier), and the fact that both of its constituent currencies are subjects of interest right now.

The U.S. dollar is the major driver of the Forex market, as approximately 85% of Forex transactions worldwide involve it. After being in a long-term bearish trend for many months, the U.S. dollar has made a substantial bullish reversal, which has been given wind by the fact that U.S. treasury yields have recently exceeded 1.5%. We are currently seeing the greenback trending upwards quite strongly and advancing against almost every major currency.

The euro is also interesting as it has stood out for several weeks as one of the weakest major currencies. This weakness can partly be explained by the continued relatively slow pace of the E.U.’s coronavirus vaccination drive, as compared to other developed economies such as the U.S. and the U.K., the latter a recent E.U. member state. This suggests that the E.U. will emerge into a fully open situation at a slow pace and its economic growth may suffer as a result, which seems to be knocking back the exchange value of the euro.

Technically, the price is trading down again today and is threatening the psychologically key round number at 1.2000. If it can get established below the 1.1950, it will be trading at a multi-month low and will technically be showing a bearish breakdown.

Much is likely to depend upon whether the nearest resistance level at 1.2021 holds up as we get deeper into the London session.

I am ready to take a short trade from a bearish reversal at 1.2021 or 1.2062 if this sets up later. I will also take a bearish bias if the price goes straight down now and makes two consecutive hourly closes below 1.1950 before the end of the London session.

There is nothing of high impoportance due today regarding either the EUR or the USD.