Bearish Case

Sell the EUR/USD and place a take-profit at 1.1650 (2nd support of standard pivot point).

Add a stop-loss at 1.1760.

Timeline: 1 day.

Bullish Case

Set a buy stop at 1.1760 and a take profit at 1.1850.

Add a stop-loss at 1.1700.

The EUR/USD price declined to the lowest level since November 4 as investors continued watching the performance of US bond yields. It is trading at 1.1700, which is 5.25% below the year-to-date high.

Stronger US Dollar

The EUR/USD declined mostly because of the overall stronger US dollar as the country’s bond yields continued to rise. The US Dollar Index has risen to the highest level in more than four months.

The US government bond sell-off continued as the market continued pricing in higher inflation. The 10-year yield surged to 1.76% while the 30-year rose to 2.4%. Bond yields are inverse to bond prices.

The performance of the bond market is primarily due to the expectations of higher inflation because of the ongoing vaccination drive and the $1.9 trillion stimulus package. Also, the Biden administration is considering another $3 trillion infrastructure package that will lead to more inflation pressure.

The EUR/USD will today react to the preliminary EU inflation numbers that will come out in the morning session. Economists expect the data to show that the headline CPI increased from 0.9% in February to 1.3% in March. Core CPI is expected to rise from 1.1% to 1.3% year-on-year in March.

The pair’s price will also be affected by the latest German unemployment numbers and US ADP employment and pending home sales numbers. Analysts expect that the German unemployment rate will remain unchanged at 6.0% while pending home sales dropped by 2.6%. Analysts also expect the ADP data to show that US private-sector employers added more than 500k jobs in March.

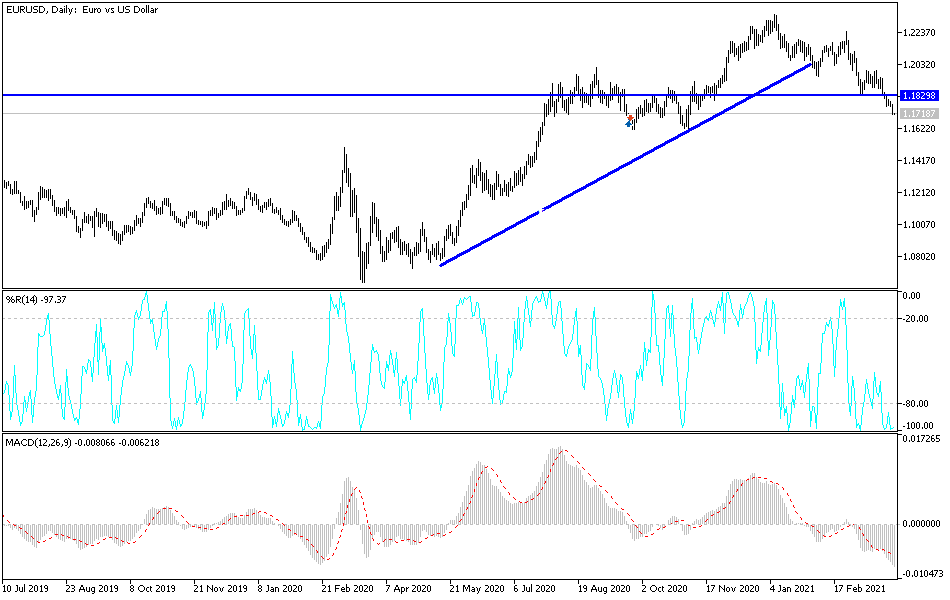

EUR/USD Technical Forecast

The EUR/USD pair has been in a steady downward trend recently. And on March 24, it moved below the important support level at 1.1835, which was the lowest level on March 9. The pair has also moved below the 14-day and 28-day weighted moving averages. It has also moved below the first support of the standard pivot points while the Relative Strength Index (RSI) has moved to the oversold zone.

Therefore, the pair will likely keep falling as bears target the second support at 1.1650, which is 0.50% below the current level. On the flip side, a move above 1.1760 will invalidate the bearish thesis.