Bearish View

Sell the EUR/USD and target the next key level at 1.1850.

Add a stop-loss at 1.1950.

Timeline: 24 hours.

Bullish View

Set a buy stop at 1.1950 and a take-profit at 1.2000.

Set a stop loss at 1.1900.

The EUR/USD price declined in early trading as investors reacted to the latest $1.9 trillion stimulus package passed during the weekend. The pair dropped to 1.1900 from the Friday’s close of 1.1927.

US Stimulus Passed

The US Senate voted for Joe Biden’s $1.9 trillion stimulus package during the weekend after days of negotiations. The bill will return to the House of Representatives and then head to Biden’s desk for signing.

The package, which is the biggest stimulus on record, brings the total congressional coronavirus stimulus package to more than $5.7 trillion. It will also take the total US debt to more than $30 trillion, which is substantially high from where it was a few years ago.

In response to the deal, the price of commodities like crude oil and copper jumped. US equity futures also rose sharply. Notably, the yields of US Treasuries also rose, with the ten-year rising to 1.53%.

The EUR/USD declined because of the overall strong US dollar as investors predicted that the deal would lead to a faster economic recovery. In the next few months, retail sales and inflation will rise and possibly force the Federal Reserve to start talking about tightening. Furthermore, the stimulus has coincided with the ongoing coronavirus vaccinations.

There will be no major data from the United States and the European Union today. Still, analysts will be focusing on this week’s European Central Bank (ECB) interest rate decision. Economists predict that the central bank will leave interest rate and the quantitative easing policies unchanged.

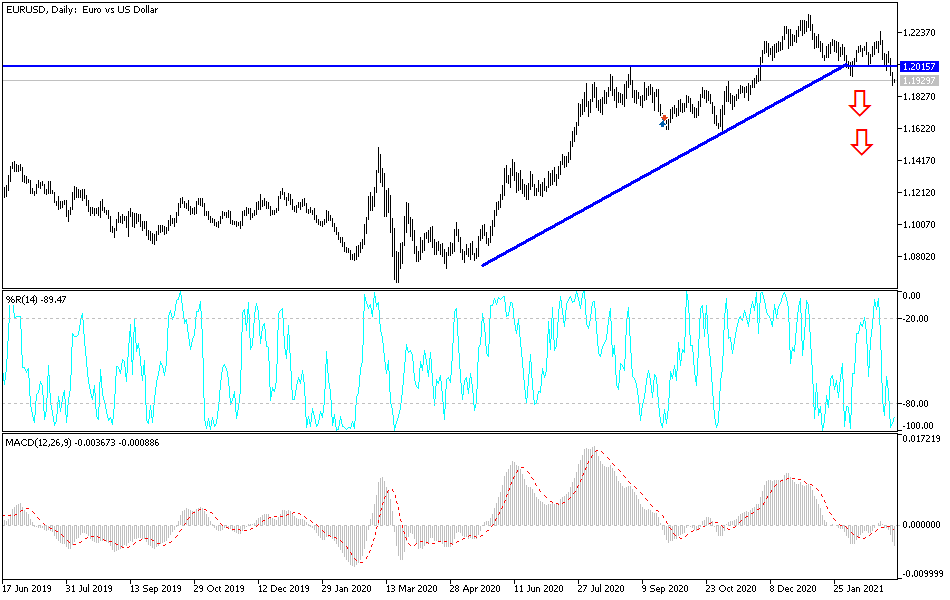

EUR/USD Technical Outlook

The EUR/USD price dropped sharply today. It dropped to an intraday low of 1.1900, which is slightly below the 25-period moving average on the four-hour chart. The price is slightly above the lower line of the Bollinger Bands while the Relative Strength Index (RSI) has dropped to the oversold level. The pair has also dropped below the vital support levels at 1.2023, 1.1990, and 1.1950.

Therefore, the path of least resistance for the EUR/USD is lower. In the near term, the pair may continue moving below the psychological level of 1.1900. If this happens, the next key level to watch is 1.1850. On the flip side, a climb above 1.2023 will invalidate this trend.