Last Tuesday’s EUR/USD signals were not triggered, as there was no bearish price action when the resistance levels identified at 1.2021 and 1.2062 were reached that day.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered before 5pm London time today.

Short Trade Ideas

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2075, 1.2106, or 1.2157.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2028, 1.1985, or 1.1969.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

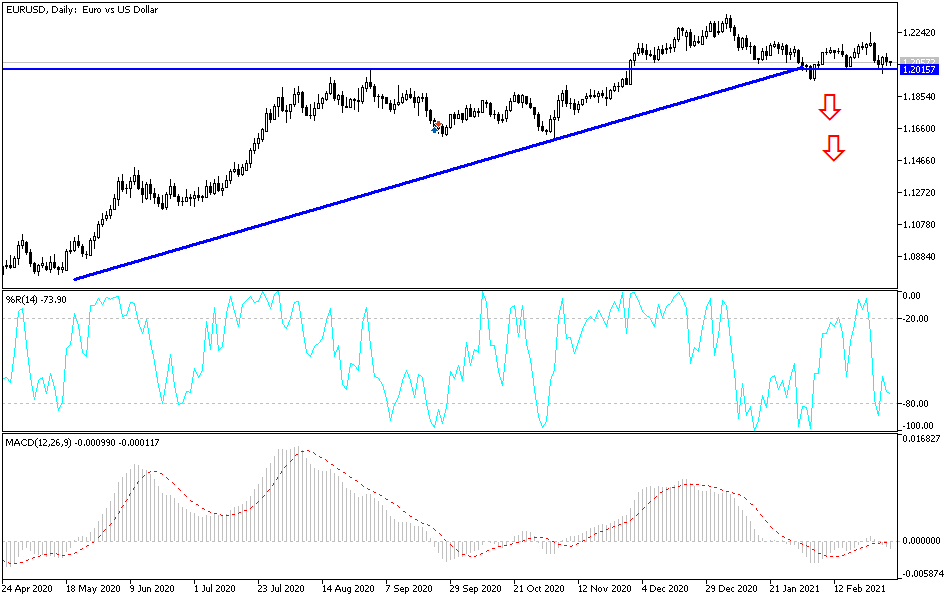

EUR/USD Analysis

I wrote last Tuesday that the price action was threatening to break below the psychologically key round number at 1.2000. If it could get established below the 1.1950, it would be trading at a multi-month low.

I thought that much was likely to depend upon whether the nearest resistance level at 1.2021 held up as we got deeper into the London session.

This was not such a great call, as the price broke below 1.2021 but then recovered strongly later in the day. However, it was enough to stay out of trouble.

Turning to the current situation, this currency pair is in an aimless consolidation on both short and long-term time frames. The best that can be said is that the support level at 1.2028 looks strong and is probably reinforced by its proximity to the big round number at 1.2000, while the resistance levels I have identified at 1.2075 and 1.2106 also look likely to be strong. Due to the absence of trend, the best approach now will probably be to look for trades at reversals of any of these levels, and then to manage any trade on short time frames.

Concerning the USD, the chair of the Federal Reserve will be speaking about the U.S. economy at 5:05pm London time. There is nothing of high importance due today regarding the EUR.