The EUR/USD pair started trading this week under bearish pressure, stable around the 1.1925 support level as of this writing. The US dollar remains strong since the announcement of the US stimulus plans and amid inflation concerns, which played a major role in the recent global bond market performance. In return, the euro is under pressure from fears of a European delay in vaccinations. Commenting on the performance of the EUR, Lee Hardman, a currency analyst at MUFG says, “Quantitative easing in itself by the European Central Bank does not necessarily have negative effects on the EUR due to the positive effect on the periphery. However, given the current higher momentum in UST bond yields, the spreads have an effect on the Forex exchange as the lowest-yielding G10 currencies suffer the most, and the potential for a wider spread and bad news about the introduction of vaccines could in the short term lead to an further weakening of the euro.”

The MUFG Bank team sold EUR/USD near 1.1935 on Friday and is looking to drop to 1.17 in the coming weeks as poor economic performance on the continent affects a market with rising growth expectations in the US and the Fed has struggled to convince investors of the idea that it could be lift interest rates sharply by 2023. This has already seen a gap or spread between European and US government bond yields moving in favor of the dollar.

The dollar's correlation to yields is seen as weak in the medium and long term, while the latter may already have rallied as much as currently possible if the Fed pushes back on previous increases this week. This should support the euro and the lower-yielding currencies that have borne the brunt of the dollar's rebound, and the euro has even been able to spot the top of its new range on the charts. The European Central Bank's actions have so far calmed European bond markets and supported the EUR above its 200-day moving average at 1.1837 - a potentially significant level of technical support in the short term - but it may not be enough on its own to keep the EUR on renewed bullish momentum.

US President Joe Biden's signature last week of a $1.9 trillion financial aid package that includes up to $1,400 in "helicopter money", which could reach eligible families as soon as this week, has raised market expectations for GDP growth. The total could help support already high inflation expectations in the US. For many, this, combined with the growing momentum of the US vaccination program, has justified the recent increase in market expectations of up to three increases in federal interest rates by 2023.

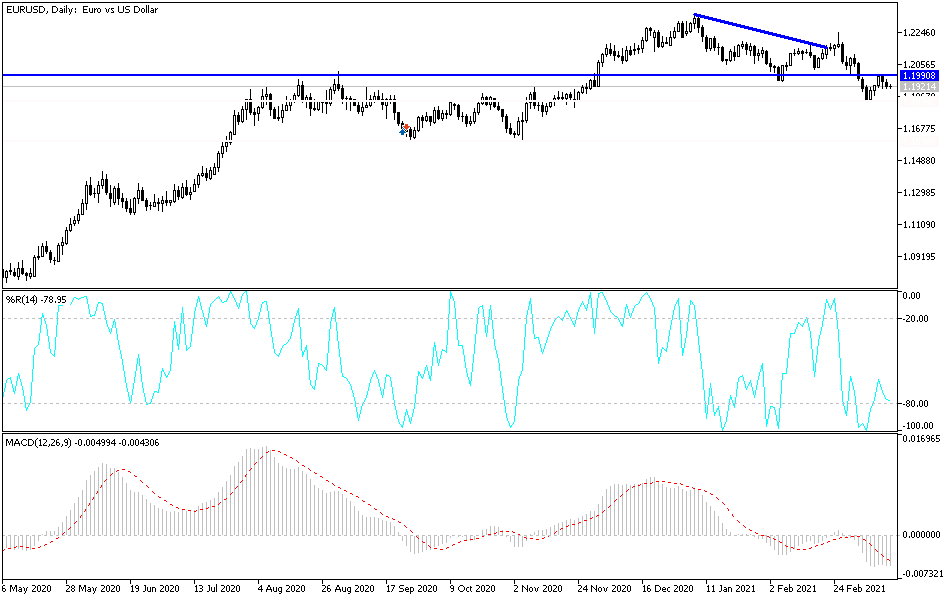

Technical analysis of the pair:

The EUR/USD is currently neutral. A breach of the psychological resistance at 1.2000 will support a move towards higher levels, which are currently at 1.2055, 1.2135 and 1.2300. On the downside, according to the performance on the daily chart, moving below the 1.1835 support level will increase the bears' control over the performance. I still prefer to sell the pair from every upside.

Today's economic calendar:

Regarding the EUR, the announcement of the ZEW reading of German economic confidence will be released. For the USD, the retail sales and industrial production figures will be released.