Amid a strong bearish performance, the EUR/USD pair is still trying not to cross the psychological support barrier at 1.1800, which would trigger profit-taking push the pair towards stronger support levels. The euro suffered a setback from new lockdowns by European countries to contain a tidal wave of coronavirus infections. All eyes are watching the Germany, as the German economy is the largest in the bloc and a direct influence on the performance of the euro.

Euro losses came to a halt relatively after IHS Markit PMI surveys revealed a record increase in output from the manufacturing sector for this month, providing temporary hope that economic stability may not be far off the mark.

The European manufacturing sector saw production rise to an all-time high in March when the block-level PMI advanced to a reading of 63.0 from 57.9 the previous month, while expectations had been for production to decline to 57.5. The gains were most noticeable in Germany, although France and the rest of the region also saw their fastest pace of growth since January 2018. The service sectors in the Eurozone have also given reason to cheer, with the rate of activity contraction among the smallest since the start of the epidemic.

The Eurozone Services PMI rose from 45.7 last month to a reading of 48.8 in March, with the recovery led by Germany again. “This indicates that first-quarter GDP could be better than expected,” said Burt Cullen, economist at ING Bank. "With the closure extended to the second quarter, we expect a rapid economic recovery at a later date.”

PMI surveys ask respondents to assess relative level conditions for a range of factors including employment, production, new orders, prices, supplier deliveries and inventories, with results represented as a number where anything above the 50 level is consistent with industrial growth while the numbers below indicate a contraction. The data is often positively correlated with GDP growth.

“We lowered our 2021 GDP growth forecast last week to 4.1% from 4.4% for the Eurozone, with similar changes for Eurozone member countries,” says Christopher Demick of Bernberg. "The German economy may grow by 3.5% instead of 4.0% this year.” Although economic activity was hit in the first quarter and the reopening of the Eurozone economies was delayed, companies remain optimistic.

Yesterday's figures may appear at first glance to indicate that the Eurozone is recovering after the economic downturn in the last quarter, but in light of the deteriorating situation of the virus on the continent, there is uncertainty about whether the emerging recovery can continue. Therefore, the euro tried to compensate for its previous losses after the issuance, but with the return of the dollar recovering against almost the rest of the major currencies and the increase in US bond yields again, the euro may face an uphill struggle.

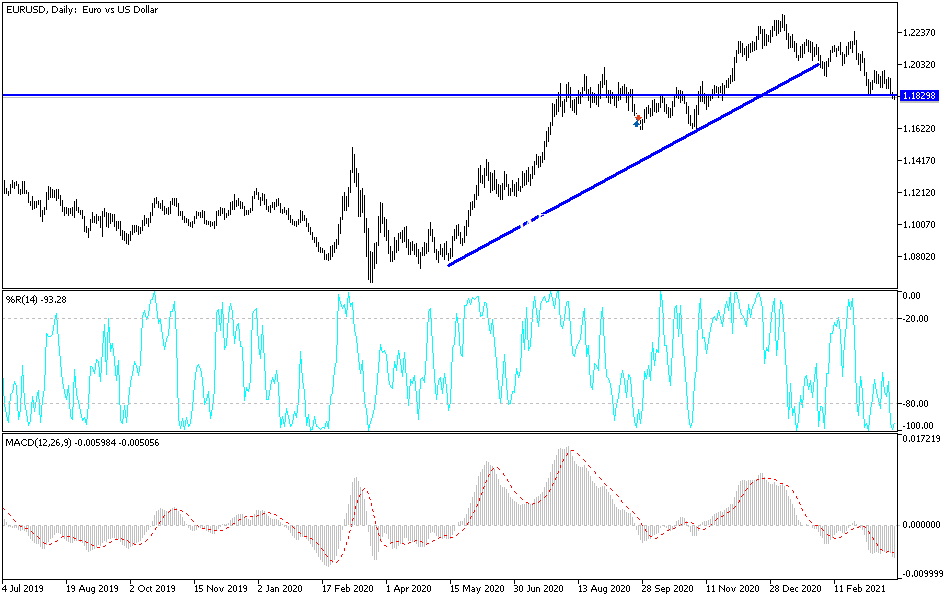

Technical analysis of the pair:

The pair is still bearish, and a break below the psychological support level of 1.1800 will increase profit-taking and thus move towards stronger support levels, the closest of which are 1.1765, 1.1690 and 1.1600. This may happen quickly if European concerns continus and more restrictions are imposed to contain infections, especially since the European vaccination rate against the epidemic is the weakest among other global economies. On the upside, I still see that a retest of the psychological resistance of 1.2000 will be the first exit from the current bearish channel.

Regarding the EUR, there will be a reading of the GFK Index of the German consumer climate, followed by the monthly report of the European Central Bank, and later the statements of European Central Bank Governor Lagarde. Regarding the USD, the weekly US GDP growth rate and jobless claims will be announced.