The EUR/USD has continued its downward correction, reaching the 1.1886 support level, near its lowest level in nearly four months. Immediately after the US Federal Reserve announced its monetary policy decisions for the month of March, the US dollar retreated. Accordingly, the opportunity for the currency pair to rebound to the upside was strong, so the bulls had to move to the resistance level of 1.1985, which is the closest to breaking the psychological resistance of 1.2000 and changes the recent bearish outlook.

The euro has swung from losses to gains against the dollar, the pound sterling and other major currencies, but Forex analysts see those moves as temporary. Commenting on the performance, Jeremy Bolton, Reuters Market Analyst, says: “Where the pair closes to the 200-DMA is vital." Bolton notes that a break through the 200-DMA in May 2020 led to a huge rally. The analyst believes that if the 200-DMA holds, it could serve as the basis for a much bigger rally to the 1.25 high this summer and the 1.35 long-term top. It indicates that the EUR/USD pair has not yet reached the minimum target for the technical correction of its rise since March of last year, which is 1.1695.

Investors are watching the bank’s decisions, despite expectations to maintain its policy. Whereas, the EUR/USD pair declined significantly between 2018 and 2020, due to a large gap in interest rates, and this gap was eliminated last year and the EUR/USD rose, but the rally was mainly inspired by the union agreement with the Historic European Rescue Fund. The returns weren't even on the concerns of Forex traders. This raises serious doubts about whether returns can drive selling at a lower price. Until January of this year, the EUR/USD rose regardless of bond moves.

Treasury yields (USTs) rose sharply thanks to the passage of the $1.9 trillion stimulus package, a reflection because investors believe that the injection of liquidity will raise inflation rates over the coming months and years. Bond investors are demanding greater compensation for holding Treasury bonds if they expect inflation to rise in the future, which in turn is reflected in the higher yield paid by the bond issuer.

The side effect of higher bond yields is the high cost of public financing that is tearing up the financial sector directly, which in turn acts as a headwind to the economic recovery. The rise in yields and inflation exclusions coincide with market pricing now with the possibility of a first interest rate hike by the Fed over the next two years, with an overall rise expected to triple by the end of 2023.

The US Federal Reserve kept its monetary policy and its historically low rates as expected and reaffirmed its confidence in the economic recovery, especially with the passage of more stimulus plans. The bank believes that there will be no consideration of raising the US interest rate before 2023.

The US Treasury Department has confirmed that it has sent 90 million economic impact payments totaling $242 billion since US President Joe Biden signed a $1.9 trillion pandemic relief plan last week. The bulk of those payments were paid by the IRS as direct deposits, which recipients began seeing in their bank accounts last weekend, officials said Wednesday. In addition, the Treasury Department mailed nearly 150,000 checks, worth about $442 million. It began processing payments last Friday, a day after Biden signed the US bailout, which allowed direct payments of up to $1,400 to eligible individuals.

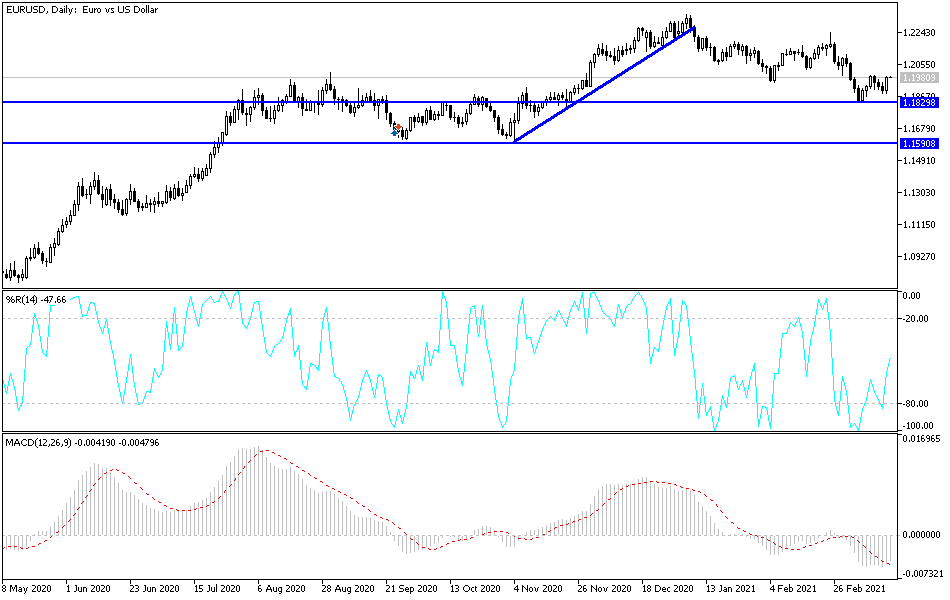

Technical analysis of the pair:

The recent rebound opportunity is important for the bulls to push the price of the EUR/USD to breach the psychological resistance of 1.2000, which may support new buying operations and thus move towards higher peaks. But at the same time, the euro’s gains are still subject to new fears of obstacles to the European vaccination drive, which remains weak. Accordingly, I believe that the resistance levels 1.2065, 1.2130 and 1.2200 are suitable to buy. On the downside, 1.1880 support is still the most important for bears to confirm the continuation of the current downtrend.

The Eurozone trade balance figures will be released. From the United States, the weekly jobless claims will be announced and the Philadelphia Industrial Index will be published.