The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

It is a good time to be trading markets right now, as there are some valid and strong long-term trends in favor of the U.S. dollar, Bitcoin, and the Canadian dollar against some other traditional safe havens such as the Japanese yen.

Big Picture 14th March 2021

Last week’s Forex market saw the strongest rise in the relative value of the Canadian dollar and the strongest fall in the relative value of the Japanese yen. Trends in the U.S. dollar are not strongly pronounced at present, with the real action in the Forex market now taking place in other currencies.

I wrote last week that the best trades were likely to be long of the USD/JPY currency pair and short of the EUR/USD currency pair. This was a good call, as although the EUR/USD rose by 0.36%, the USD/JPY rose by even more at 0.61%.

Fundamental Analysis & Market Sentiment

The headline takeaway from last week is that the market sentiment globally moved more strongly into risk-on mode. We saw rises in risky assets such as stock indices, Bitcoin, and riskier commodity currencies such as the Canadian dollar. Most major global stock indices rose over the week.

The U.S. dollar fell a little over the past week, after performing strongly in recent weeks, despite a renewed increase in the 10-year U.S. Treasury yield to well beyond the benchmark 1.5% rate. The pace of the rise in yields over recent weeks has been faster than at any time in the previous 25 years, leading to concern about the re-emergence of inflation as a problem in advanced economies. The major event last week affecting U.S. markets was the passage of a new $1.9 trillion coronavirus relief bill which will entail payments of $1,400 to most adult Americans and inject liquidity into the U.S. economy.

Last week saw monthly input from the European Central Bank and the Bank of Canada, both of which held rates steady. The ECB release was the more notable event as it pledged to increase the short-term pace of its QE bond purchasing program.

While the U.S. economy looks set to enjoy a new spurt of demand-led growth, the Eurozone is facing the problem of a resurgent coronavirus due to its very slow vaccination program. Italy and some other nations are reimposing lockdown restrictions, which is bound to have a chilling effect on Eurozone economic growth.

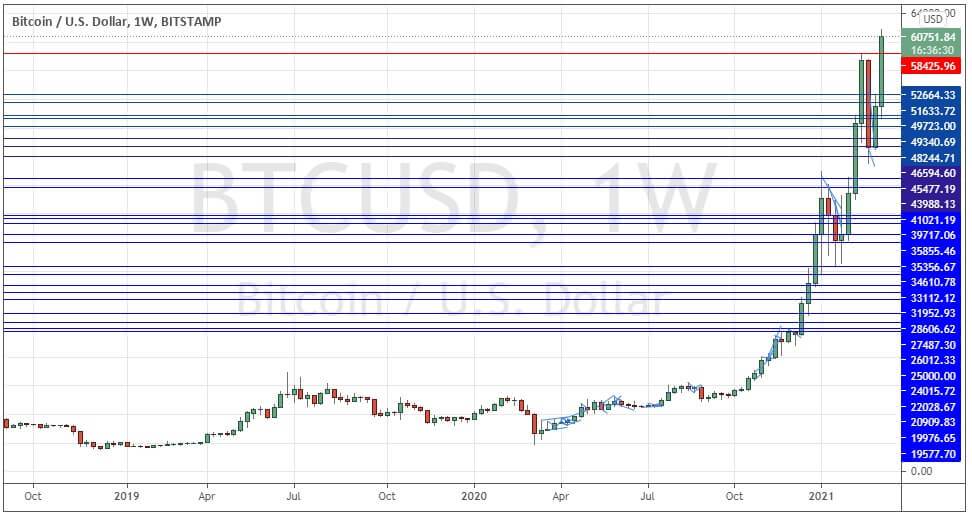

Bitcoin finally broke beyond the key resistance level at $58,426 to make a new all-time high price above $60K over the weekend.

The coming week will bring a lot of important data releases concerning the Forex market, with the U.S. FOMC statement and projections due, plus monthly policy input from the Bank of Japan and the Bank of England.

Last week saw the global number of confirmed new coronavirus cases rise for the first time in over two months, driven mainly by a resurgence of the virus in Europe. However, the total number of global deaths fell again last week.

Many countries have begun vaccination programs. Excepting extremely small nations, the fastest progress towards herd immunity has taken place in Israel which has administered 106 shots per 100 of its population, followed by the U.A.E. with 66 shots. Both nations have seen their respective numbers of new cases fall dramatically over recent weeks.

The strongest growth in new confirmed coronavirus cases is happening in Armenia, Austria, Bangladesh, Bosnia, Brazil, Bulgaria, Cambodia, Cameroon, Chile, Cyprus, Denmark, Estonia, France, Germany, Greece, Guatemala, Hungary, India, Iraq, Italy, Jamaica, Jordan, Kenya, South Korea, Lebanon, Mali, Malta, Mongolia, Montenegro, Netherlands, North Macedonia, Norway, Pakistan, Philippines, Poland, Romania, and Serbia.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that the U.S. Dollar index printed a weakly bearish near-doji candlestick last week which followed a large bullish candlestick from the week before. The consolidation of the past few weeks appears to have ended, with the dollar showing some bullish momentum. Despite that, the Index is still below its prices from three and six months ago and below a nearby resistance level, suggesting that the upwards movement may be capped over the near term. Overall, next week’s price movement in the U.S. dollar looks unpredictable. For this reason, it will probably be wise to focus on assets other than the USD as key drivers over the coming week, although this may well change after the FOMC release due on Wednesday.

USD/JPY

This major currency pair printed a third consecutive strong bullish weekly candlestick which closed at a 6-month high price on Friday near the top of its weekly range. These are bullish signs, with the Japanese yen acting as a generally weak currency in recent weeks. This Forex currency pair looks somewhat likely to rise further, but may well struggle to get any higher once it begins to approach the major psychological round number at 110.00.

USD/CAD

We saw a strong, relatively large bearish candlestick in this currency pair last week, closing right near the low of its range. This is the lowest weekly close in over 3 years. The price also briefly traded at a 3-year low price, and crude oil, which is a major part of the Canadian dollar, is also trading near a long-term high. These are all bearish signs, and it is likely that the price will continue to fall over the coming week.

BTC/USD (Bitcoin)

Bitcoin’s incredible meteoric rise continued last week, as another powerful bullish candlestick was printed. The price has just broken strongly above what was a firm resistance level at $58,426 and is still (at the time of writing) trading above the major round number at $60K. Although Bitcoin can be very volatile, which means traders should always trade it small and use volatility-based hard stop losses, it looks likely to rise further over the coming week.

Bottom Line

I see the best likely opportunities in the financial markets this week as being long of Bitcoin and the Canadian dollar and short of the Japanese yen.