The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

It is a moderate time to be trading markets right now, as there are a few valid long-term trends left in favor of the Australian and Canadian dollars against some other traditional safe havens such as the Japanese yen.

Big Picture 21st March 2021

Last week’s Forex market saw the strongest rise in the relative value of the Swiss franc and the strongest fall in the relative value of the euro, although the numbers were small enough to have little meaning. Trends in the U.S. dollar are not strongly pronounced at present, with the real action in the Forex market now taking place in other currencies.

I wrote last week that the best trades were likely to be being long of Bitcoin and the Canadian dollar and short of the Japanese yen. This was not a profitable call as Bitcoin fell by 1.50% while the CAD/JPY currency cross also fell by 0.41%, giving an averaged loss of 0.96%.

Fundamental Analysis & Market Sentiment

The headline takeaway from last week is that the market sentiment is somewhat confused. Demand has been stoked by dovish monetary policy plus stimulus in the U.S., but it has been shadowed by fears that policy will lead to untenable inflationary pressures.

The U.S. dollar rose slightly over the past week, seeing a renewed increase in the 10-year U.S. Treasury yield to a 14-month high of 1.7%. The pace of the rise in yields over recent weeks has been faster than at any time in the previous 25 years, leading to concern about the re-emergence of inflation as a problem in advanced economies. The major event last week affecting U.S. markets and the Forex market generally was the FOMC statement and forecast which promised no rate hikes through 2023. This was viewed as somewhat unrealistic by analysts, which has spooked the market a bit.

Last week also saw extremely strong Australian employment data and much poorer than expected New Zealand GDP numbers.

The Eurozone continues facing the problem of a resurgent coronavirus due to its very slow vaccination program. Poland and France are following Italy and some other nations in reimposing lockdown restrictions, which is bound to have a chilling effect on Eurozone economic growth.

The coming week will bring quarterly policy input from the Reserve Bank of Switzerland and testimony by the Chair of the U.S. Federal Reserve before Congress.

Last week saw the global number of confirmed new coronavirus cases rise for the second consecutive week after falling for over two months, driven mainly by a resurgence of the virus in Europe. The total number of global deaths also rose last week for the first time in two months.

Many countries have begun vaccination programs. Excepting extremely small nations, the fastest progress towards herd immunity has taken place in Israel which has fully vaccinated 50% of its population, followed by the U.A.E. at 22%. Both nations have seen their respective numbers of new cases fall dramatically over recent weeks.

The strongest growth in new confirmed coronavirus cases is happening in Andorra, Argentina, Armenia, Austria, Bahrain, Bangladesh, Belgium, Bosnia, Brazil, Bulgaria, Canada, Chile, Colombia, Cyprus, Ecuador, Estonia, Ethiopia, Finland, France, Germany, Greece, Guatemala, India, Iraq, Italy, Jordan, Kazakhstan, Kenya, Luxembourg, Mali, Moldova, Mongolia, Netherlands, North Macedonia, Norway, Oman, Pakistan, Paraguay, Philippines, Poland, Romania, Serbia, Somalia, Sweden, Ukraine, Uruguay, and Venezuela.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar index printed a weakly bullish near-pin candlestick last week which followed a weakly bearish near-doji candlestick from the week before. The consolidation of the past few weeks appears to have ended, with the dollar showing some bullish momentum. The index is finally above its price from three months ago which is a bullish sign but is still below a nearby resistance level as well as sitting below its price from six months ago, suggesting that the upwards movement may be capped over the near term. Overall, next week’s price movement in the U.S. dollar looks somewhat likely to be bullish, but the upside may be limited. For this reason, it will probably be wise to focus on trading the USD long only over the coming week.

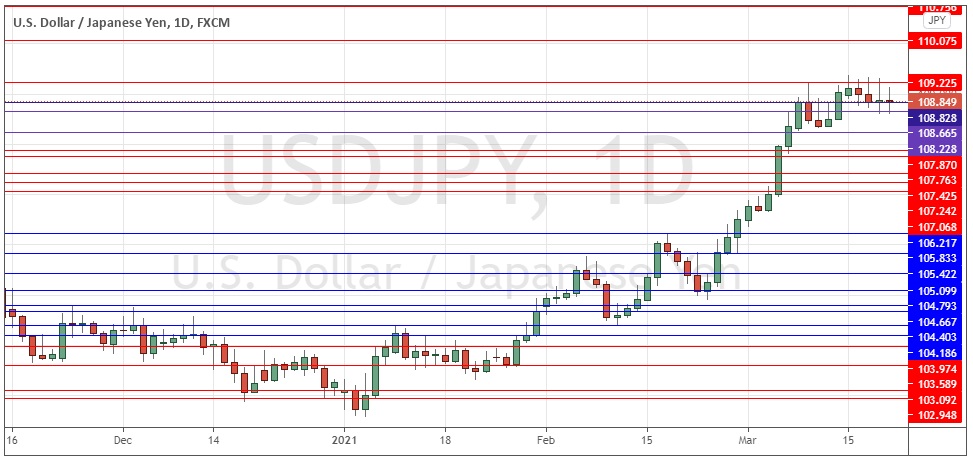

USD/JPY

This major currency pair despite being clearly within a long-term bullish trend traded within a narrow and seemingly topping range just under the key resistance level at 109.23. This puts the trend in some doubt but a daily close above 109.23 will suggest that the trend is ready to resume following a bullish breakout if it happens. I therefore see the best approach as to wait for a daily (New York) close above 109.23 and then to go long here.

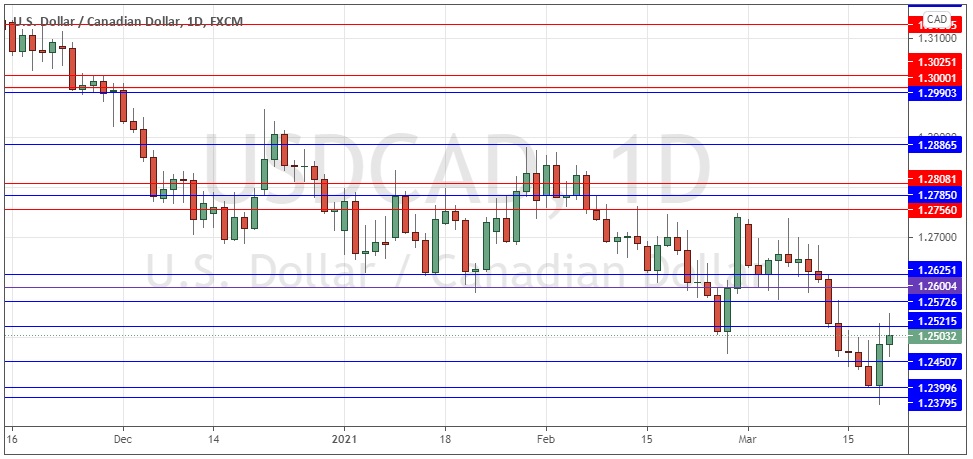

USD/CAD

This major currency pair despite being clearly within a long-term bearish trend seemed to strongly reject the supportive area at 1.2400 over the past week. This puts the trend in doubt but a daily close below 1.2400, while unlikely to happen, will suggest that the trend is ready to resume following a bullish breakdown if it happens. I therefore see the best approach as to wait for a daily (New York) close below 1.2400 and then to go short here.

Bottom Line

I see the best likely opportunities in the financial markets this week as being long of USD/JPY following a daily close above 109.23 and a less attractive trade in being short of USD/CAD following a daily close below 1.2400.