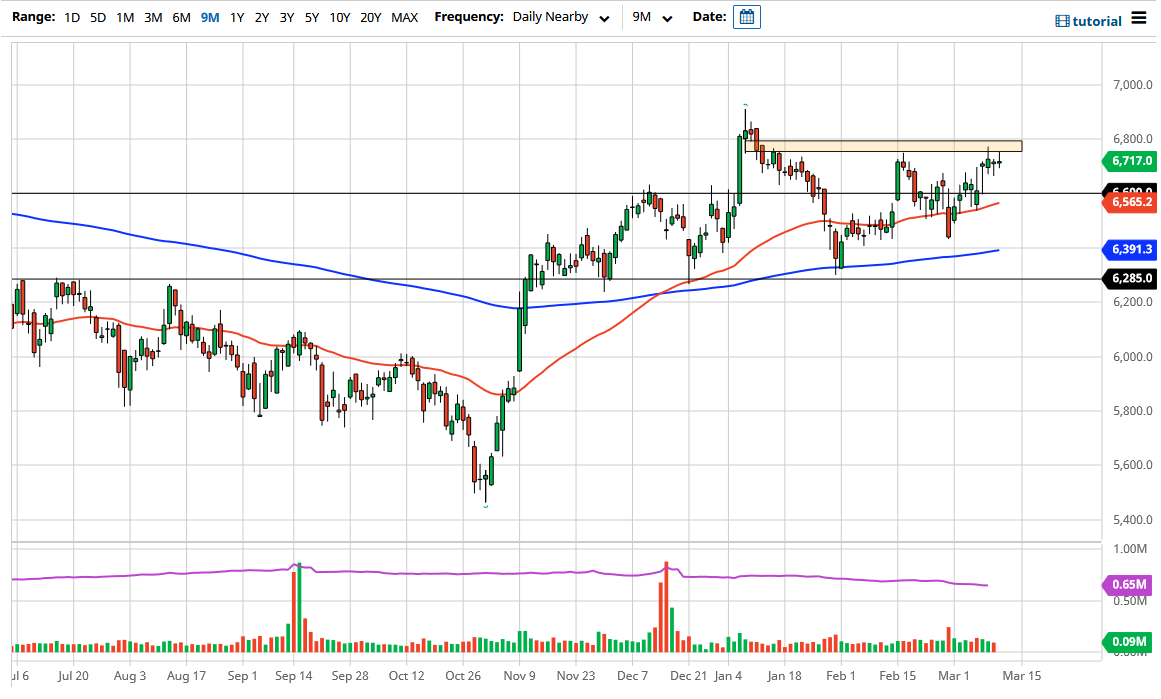

The FTSE 100 has gone back and forth during the course of the trading session on Thursday as we have formed a shooting star that was preceded by a hammer during the Wednesday session. Previously, we have formed the same pattern of a hammer and a shooting star, so at this point in time I think that what we are looking at is a scenario where we are trying to put up the necessary momentum to take off to the upside.

Looking at this chart, we could see a bit of a pullback that goes looking towards the 6600 level, which is an area that previously has been both support and resistance, but it is also a large, round, psychologically significant figure. Furthermore, the 50 day EMA is starting to reach towards that level and is slanted to the upside. In other words, I like the idea of buying dips based upon “value”, as long as stocks in general continue to see an upward bias worldwide. After all, the FTSE 100 is highly levered to the idea of the UK being much more aggressive about vaccinating it is citizens, and of course the idea that the Brexit was not as devastating as people once had thought.

If we can break above the 6800 level, then it is likely that the market goes looking towards the 6900 level, possibly even the 7000 level which is my longer-term target. After all, the 7000 level will be attractive for certain people, and of course cause a lot of headlines. Nonetheless, I think that is a target that a lot of people will be looking towards. We are in an uptrend, and stock markets tend to go towards the bigger figures, so with that being the case, I think that we are likely to see a lot of volatility, but I we continue to look at this market as one that you should be a buyer of, and not a seller of. In fact, I have no interest in selling this market until we break down below the 200 day EMA, which is close to the 6400 level. Underneath there, then I think the market could accelerate to the downside and the FTSE 100 would be in serious trouble. Ultimately, that could open up a move towards the 6000 handle rather quickly.