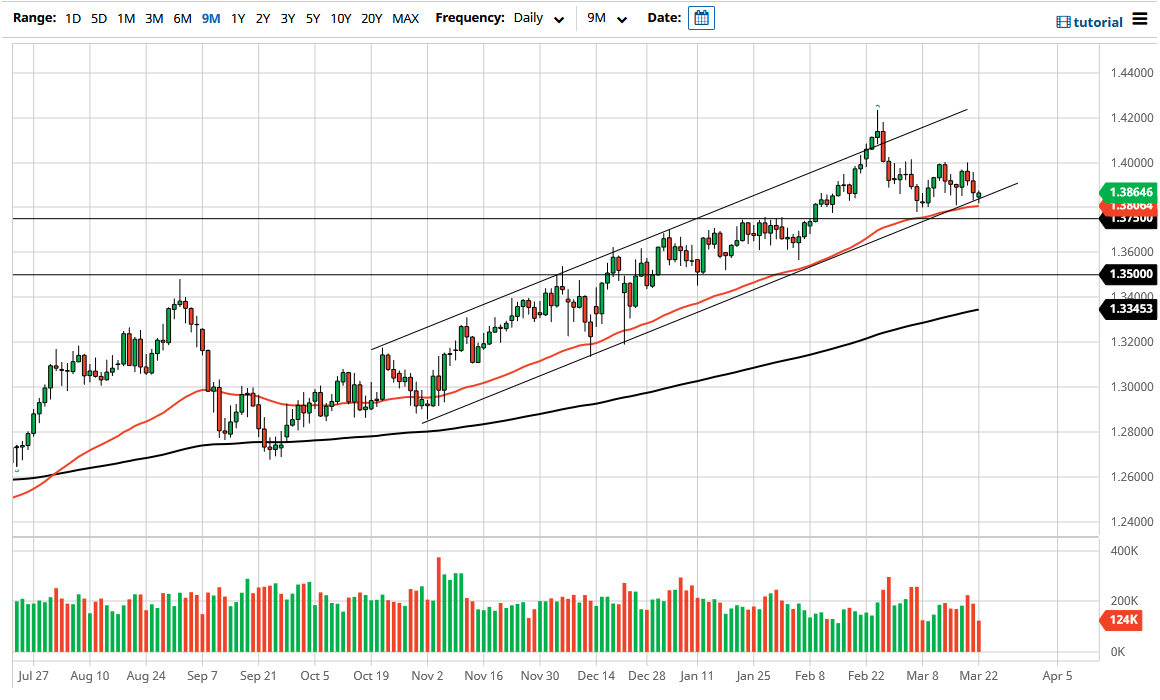

The British pound has fallen initially during the trading session on Monday only to turn around and show signs of life. At this point, the market looks as if we may be trying to recover to reach towards the 1.40 level, but that does not necessarily mean that it is going to be easy to get to. Nonetheless, it certainly looks as if it is going to continue to see value hunters as the British pound has been strong for so long. Furthermore, you need to look at the uptrend line that is the bottom of the up trending channel as it has offered a nice support level again.

The 50 day EMA sits just below there as well, so it does make sense that we would see a certain amount of resiliency and that general vicinity. Furthermore, the 1.38 level is right there as well, and extends down to the 1.3750 level. All of that does make sense as it could be a major “floor the market”, as we have seen so much reaction in this vicinity. However, it also works both ways. What I mean by this is that if we break down below that area, this market could fall to the 1.35 level rather quickly.

On the other hand, if we can get to the 1.40 level then we need to see whether or not we can continue to go higher. If we can, then the market is likely to revisit the 1.42 handle, which has been major resistance on the weekly charts more than once, and therefore it is worth paying close attention to any move that is above there. If it does happen, it could open up the possibility of a move towards the 1.45 handle, which of course is the next big figure.

The British pound has been strong for quite some time, and the US dollar has been beaten up against it but has shown a certain amount of strength against other currencies. That is part of what is because of the choppiness at the moment so I think at this point what we are waiting to see whether or not we can get any type of momentum. The Monday candlestick itself was a little lackluster, but it did at least show us that the support level underneath it still intact.