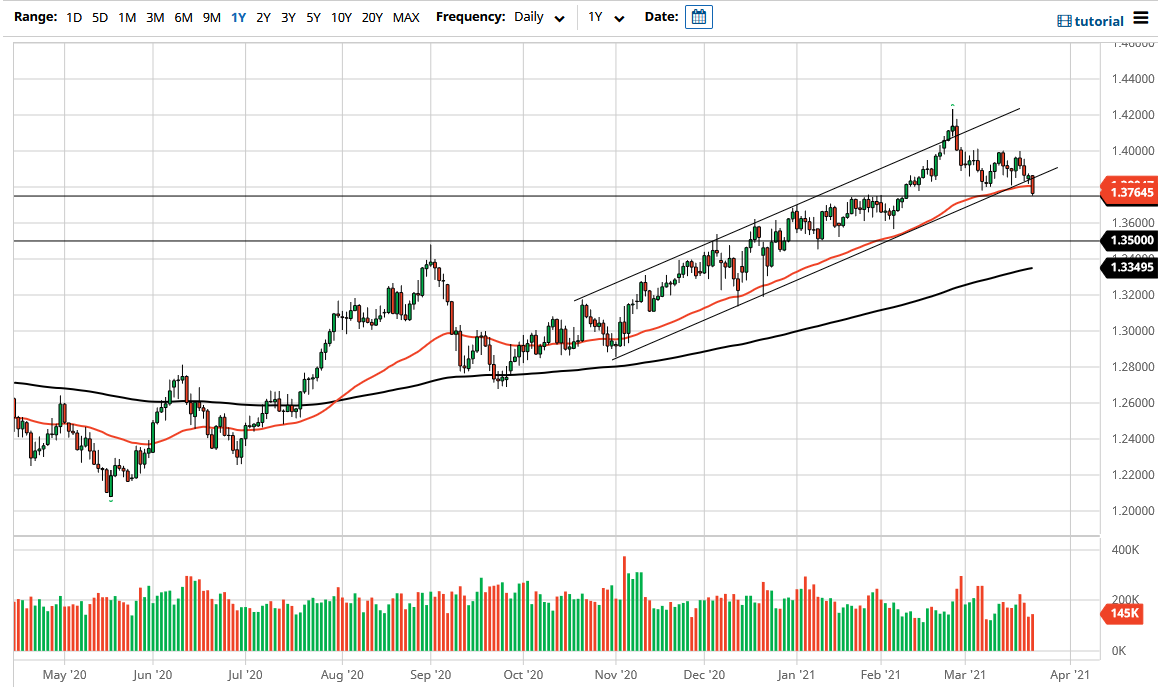

British pound traders sold early during the trading session on Tuesday and continued to do so throughout the day. In fact, we ended up busting through an uptrend line that has been part of a well-defined channel, which was the first real trouble that we have seen in the market in general. That being said, the 1.3750 level is massive support, and the 50 day EMA is sitting in the same general vicinity as well.

While this certainly does look bearish, I do believe that the 1.3750 level is crucial for support, but even if we break down below there, I think there is also even more support to be found down at the 1.35 handle, so that being said I think that even if we do break down, we will probably find plenty of support. The 200 day EMA sits just below it as well and is reaching towards that general vicinity. Although the British pound looks rather soft at this point, it has been so bullish for so long that if you are going to be buying the US dollar, you are probably better off buying it against other currencies.

The British pound has seen a bit of resiliency due to the fact that Brexit had pushed the currency so low for so long. That being said, even if we were to pull back to the 1.35 handle, it will probably only end up being a bit of a value play given enough time. To the upside, we have the 1.40 level which has been a resistance barrier for the last couple of weeks, and then of course we have the 1.42 level above there where we had recently pulled back from. That is an area that is crucial on the weekly and monthly charts, so therefore it is not overly surprising to see that the market could not break above there. If we do though, that opens up the possibility of reaching towards the 1.45 handle. I do believe that we are more likely to see a pullback here than some type of significant bounce, but you are probably going to be better off buying the greenback against other currencies at this moment, as historically speaking the British pound is still about 12% cheaper than the norm, so you will get more “bang for your buck” against other currencies.