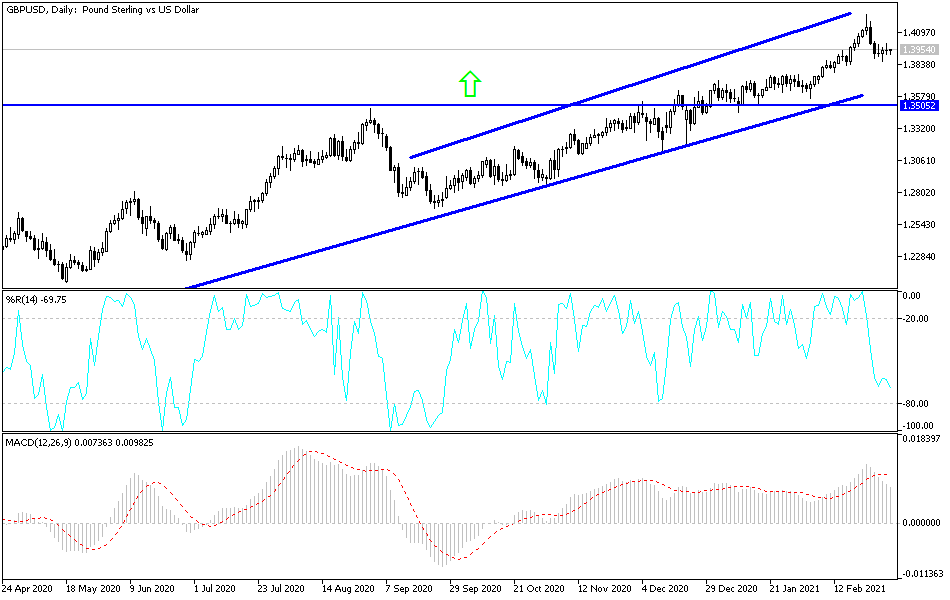

The British pound rallied slightly during the trading session to reach towards 1.40 level before pulling back a bit and then bouncing again. At this point, the market looks as if we are trying to break above that 1.40 level, and if we can, then the market is likely to go pressing the 1.42 level above to retest the resistance. After all, we are in a nice uptrend, so there is no reason to find that attitude and I do think that it is only a matter of time before we would see people trying to re-enter the fray. By breaking above the 1.40 level, we have the added benefit of busting through the top of the shooting star from the trading session on Monday. That is one of my favorite signals to start buying.

To the downside, we have plenty of support near the bottom of the candlestick for Tuesday, not only due to the fact that we bounced from there, but the fact that we have a nice uptrend line underneath. Even if we were to break down below this uptrend line, I think that we will continue to see support at the 1.3750 level, which is the previous resistance level and now we could fall to retest that region. Beyond that, we also have the 50-day EMA reaching towards that level, so I think it is very likely that this market will find plenty of buyers underneath.

If we do break above the 1.40 level, then it is likely that we will see more of a flush higher; but we should also keep in mind that the rest of this week could be relatively quiet until Friday morning in New York when we get the jobs number from America. After all, that will have a major influence on the US dollar, which is half of the equation when we look at this market. Furthermore, we have to look at the idea of the UK continuing to strengthen based upon vaccinations, especially when compared to other major economies. At this point, the simplest way to look at this chart is to look at the nice uptrend that we are in, so you should not be looking to sell this market. Dips should continue to offer value that people will look at.