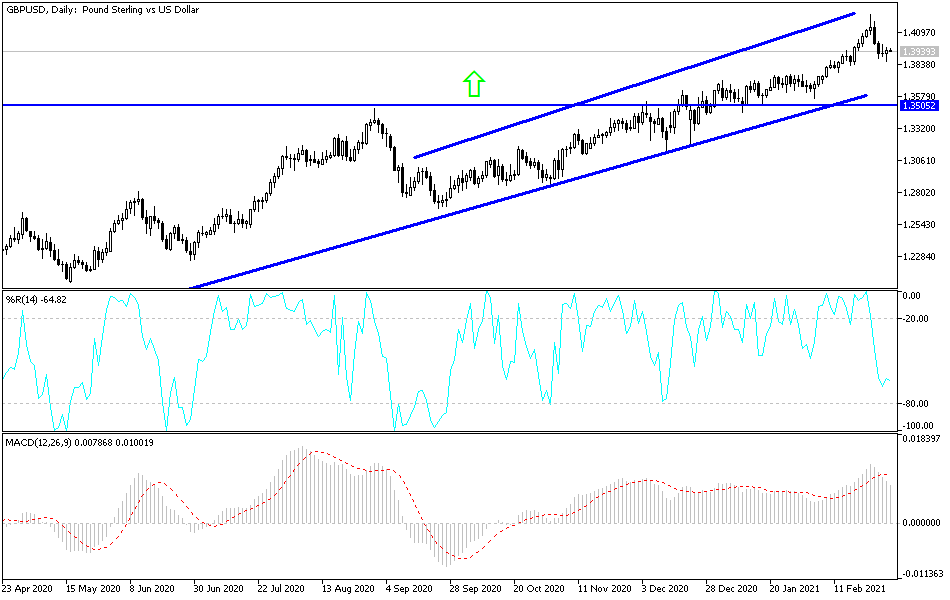

The British pound initially fell during the trading session on Tuesday to show signs of weakness again, but by the end of the day it turned around completely to form a massive hammer. If we can break above the 1.40 level, it is likely that we will go back towards the highs again. In fact, I think that it will release a fresh new torrent of buyers, in an attempt to get towards the 1.42 level, which was where we have seen so much in the way of selling pressure.

I think the main reason that this market has struggled at the 1.42 level was mainly due to the fact that we got far too overextended, and you should keep in mind that the level is also important on the weekly chart, so obviously we would struggle in that general vicinity if we do not build up enough sustainable pressure. The market is trying to build up that massive pressure to finally make the break. If we can break above the 1.42 level, it is likely that the British pound will go looking towards the 1.45 level over the longer term.

Even if we do pull back from here, I think there are plenty of buyers underneath near the uptrend line and the 1.3750 level underneath. It is also backed up by the 50-day EMA as well, so we should find plenty of buyers. I recognize that this is a market that has been in a nice predictable channel, and it looks like we have seen the channel hold yet again during the trading session. It is not until we break down below the 1.3750 level that I would be concerned. If we do break down below there, then we could see a little bit more of an unwind down to the 1.35 handle.

I think short-term dips will probably continue to be buying opportunities on short-term charts, but pay attention to the bond yields, because the US yields rising have given the US dollar little bit of a boost as of late. Longer term, I do believe that we will continue to see the uptrend push this market higher, but if we were to break down below the 1.35 level then I think we could see something more significant to the downside.