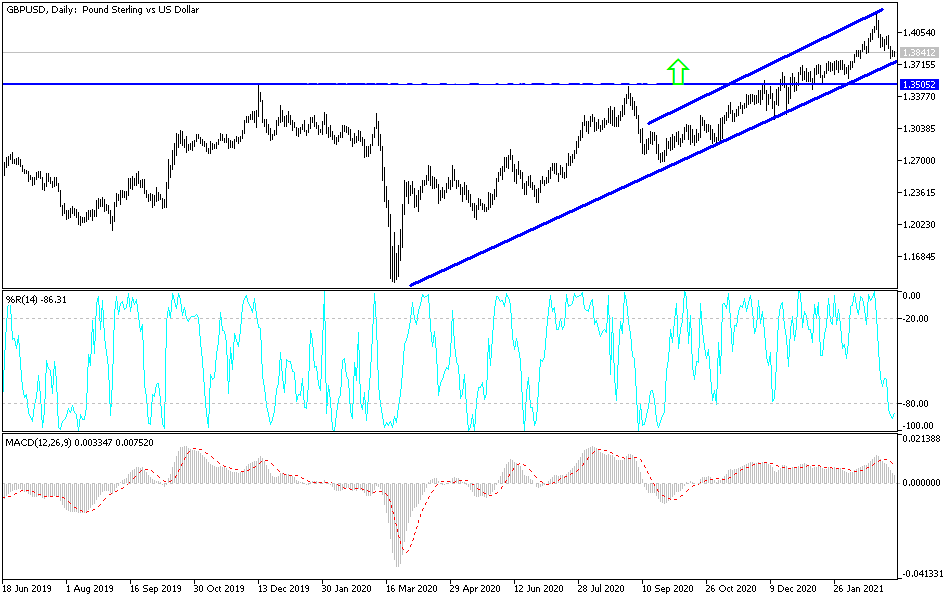

The British pound fluctuated during the trading session on Monday as we continue to walk along the major uptrend line that forms the channel we have been in. Furthermore, we have the 50-day EMA sitting just below, which is backed up by the 1.3750 level. That is an area where we have seen a significant amount of resistance previously, so it does make sense that there would be “market memory” in this general vicinity. If we did break down below there, then it is likely that we could go looking towards the 1.35 handle rather quickly.

On the other hand, we can break above the top of the candlestick for the trading session on Monday, which opens up the possibility of a move towards the 1.40 level. That is a large, round, psychologically significant figure that a lot of people would be paying attention to, but it has been sliced through previously, so it is worth seeing whether or not we can break above there. If we do, then it opens up the possibility for a move towards the 1.42 level again, which is where we sold off from. That level is resistive on the weekly chart, so it has caused a lot of attention and profit-taking.

The uptrend is very much intact, and as long as the 10-year yield does not completely explode as we have seen as of late, then the stimulus coming out of America will continue to put downward pressure on the greenback. Furthermore, the UK opening up its economy also helps the British pound. At this point, as long as we get some type of shock to the system, the market is likely to go higher on these dips. The candlestick for the day was a little less than exciting, but it suggests that we could see at least some type of stabilization. Because of this, I think that breaking above the top of the candlestick is reason enough to get long. One thing is for sure: this is a market that has been absolutely relentless on its way higher, as the 50-day EMA has offered such reliable support multiple times on the way up.