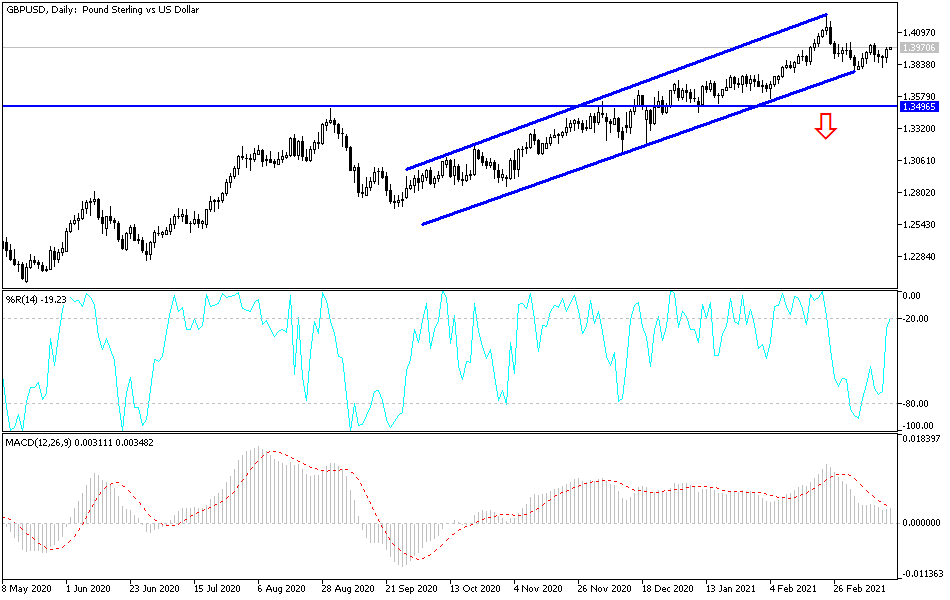

The British pound has initially fallen during the trading session on Wednesday to dip below the uptrend line that has been such a staple of the bullish run higher. The FOMC caught a lot of attention, as we heard Jerome Powell suggesting more of the same, and therefore traders had to reiterate the idea that the US dollar probably will get sold off, even though we have seen yields spike in the United States.

From a technical analysis standpoint, you can see that the previous session had formed a massive hammer that tested the 50-day EMA underneath. The 50-day EMA sits just above the 1.3750 level, an area that was previous resistance so it should now be supportive. Furthermore, you can see that I have drawn a strong channel, and it certainly looks as if we have held in it. That is a strong sign, and I think at this point we are eyeballing the 1.40 level. If we can break above there, then it is likely that we will continue to reach towards the 1.42 handle.

Looking at this chart, it is not until we break significantly lower that I would be concerned about it. If we do break down below the 1.3750 level, it probably opens up a move down to the 1.35 handle. That is where I begin to worry about the overall efficacy of the uptrend, and therefore I think at this point all you are doing is looking for short-term pullbacks to buy in a market that is obviously very strong. When you look at the pullback from the 1.42 level, it made sense that we had seen massive selling, mainly due to the fact that the 1.42 level was a major resistance barrier on the weekly and monthly timeframe. We had gone straight up in the air to reach that level, so momentum would have always been some type of concern. However, if we were to go sideways for a bit like we have, then you can start to talk about the idea of perhaps building up enough momentum to go higher. Once we get that momentum built up completely, this is a market that should go looking towards the 1.42 level, and then possibly the 1.45 over the longer term.