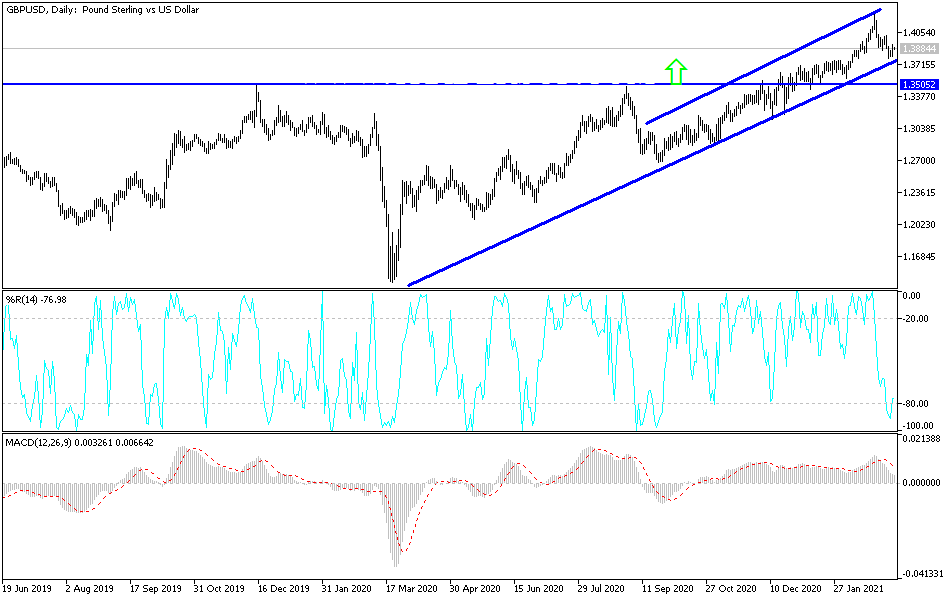

The British pound rallied a bit during the trading session on Tuesday to bounce from a crucial uptrend line. In fact, we even broke above the highs of the previous session, which turned the candlestick into an “inverted hammer”, which is a bullish sign. At this point, if we can break above the highs during the trading session, it is very likely that the British pound will go looking towards the 1.40 level above, which will attract a certain amount of attention.

Underneath, we not only have the uptrend line, but we also have the 50-day EMA coming into the picture, which will also attract buying pressure. After that, we have the crucial 1.3750 level, which will attract a certain amount of “market memory.” At this point, I think that we have made a significant statement during the trading session on Tuesday, and I think that we are more than likely going to continue grinding away in this overall channel. That channel means that we could go looking towards 1.42 level again, which is a major resistance barrier based upon the weekly timeframe. That obviously carries a certain amount of weight, and the fact that we shot straight up there means that we were always going to struggle to simply slice through it the first time.

In fact, if you have been following me here at DailyForex, you know that I said that a pullback towards the 50-day EMA was very possible, in order to build up enough momentum to turn things around and make another attempt on that level. Now the question is whether or not we can build up enough momentum, which will be crucial. The size of the candlestick also suggests that there is a certain amount of momentum reentering this market, but I do think that the 1.40 level is going to be very difficult. It is not until we break down below the 1.35 handle that I would be a seller of this pair, because at that point I think there would be a significant amount of trend change potential jumping back into the market. When you look at the channel, it is obvious that we are simply grinding away in the same type of pattern that we have been in for some time.