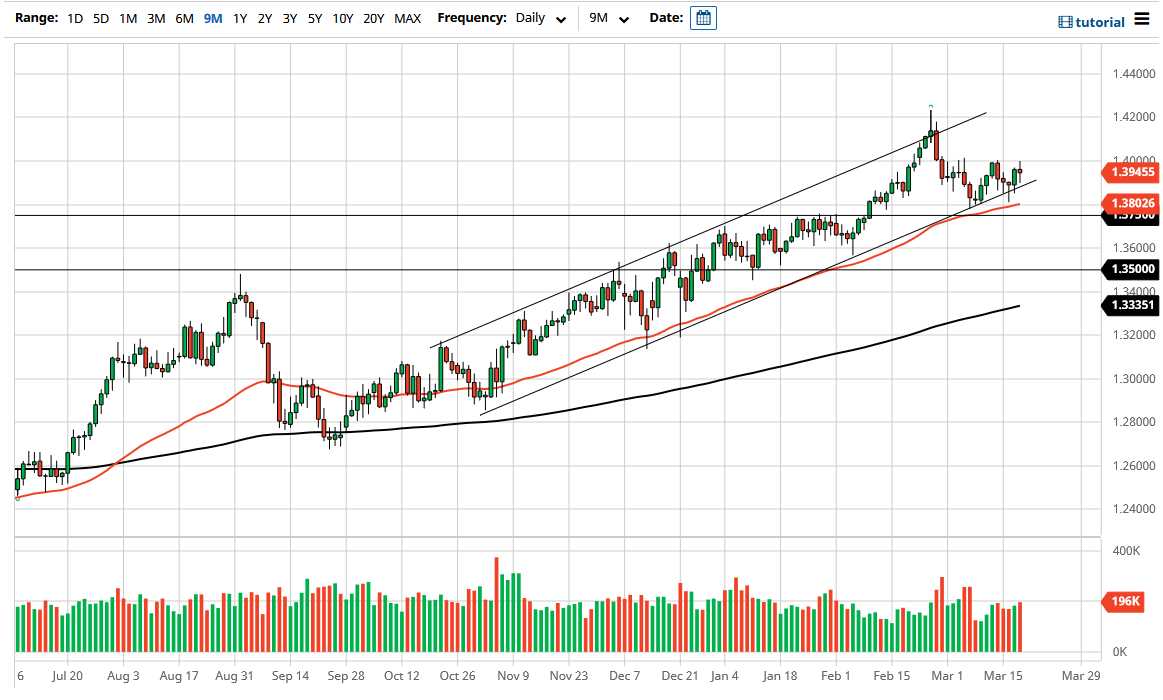

The British pound tried to rally during the trading session on Thursday but ran into a buzzsaw of resistance at the 1.40 level yet again. This is an area that has been very difficult to get through, so if and when we finally do break above this level, the British pound is going to shoot much higher. At this point, we will probably see some type of attempt to break out again, but the longer this goes on, the more likely it is to fail yet again.

From a technical analysis standpoint, we are still very much in an uptrend and we are still very much in an uptrending channel. That is typically a good enough reason to get long of the market, but it is going to be very difficult to simply buy-and-hold something, especially as the bond markets in America have been playing happy with anything related to risk appetite.

Compounding the situation is that the Bank of England gave no hints whatsoever about tightening monetary policy during its Monetary Policy Committee statement on Thursday, although I think it was a bit hopeful to expect that they would have said something. We are currently in a situation where all central banks around the world are trying to debase their currencies at the same time, so it should not be a huge surprise that we are essentially “stuck” when it comes to what to do next.

If we can break above the 1.40 level, I will be a buyer of the British pound and aim towards the 1.42 handle again. On the other hand, if we break down below the 50-day EMA, then I will look to buy it closer to the 1.3750 level, possibly even the 1.35 level after that, which I would consider to be the “bottom of the overall trend” and then would have to consider that the uptrend is completely broken. Until that happens, I am a buyer of dips in general, but also recognize that things are getting really messy and difficult to deal with on a day-to-day basis and that something that should not be ignored.