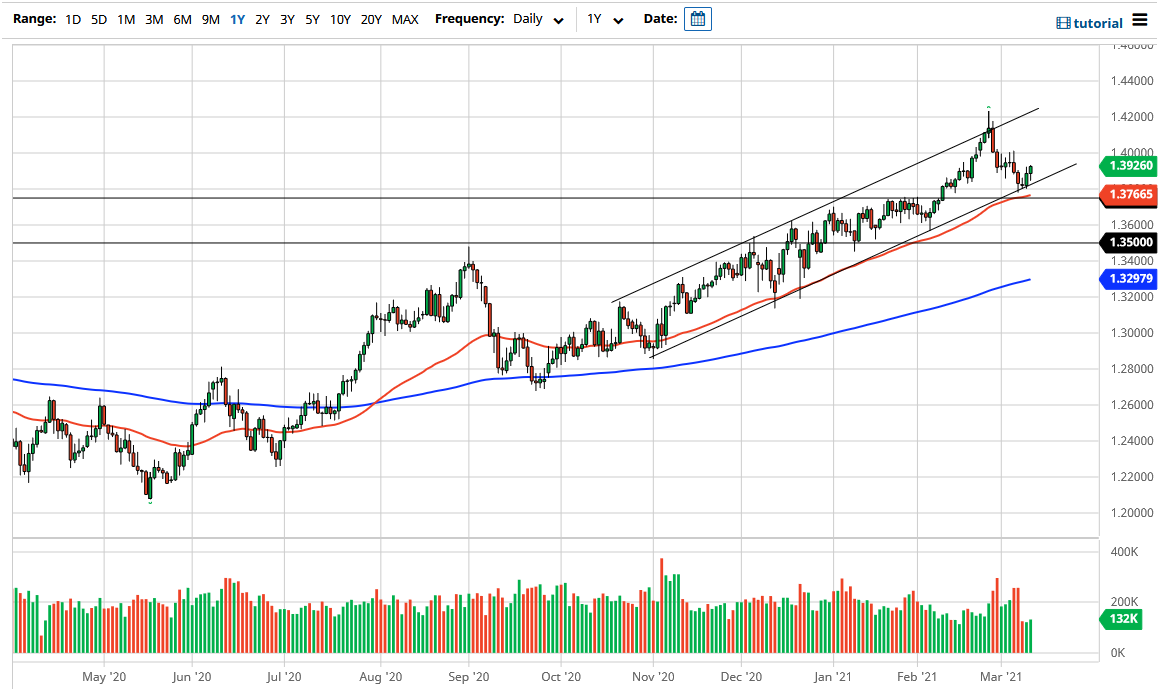

The British pound initially pulled back during the trading session on Wednesday to reach towards the uptrend line, and that of course shows that we should continue seeing more of what we have been looking at for some time. The market now appears as if we are going to go looking towards 1.40 level above, which is a large, round, psychologically significant figure. This should offer a little bit of resistance, but at the end of the day we have already poked above there, so I think that the 1.42 level is the real prize. That being the case, I think that given enough time we will see a serious attempt to get above there.

On the other hand, you should also keep an eye on the support underneath that we not only have seen with the uptrend channel, but the 50 day EMA that has broken above the 1.3750 level as well, so I think that also comes into push the British pound higher.

One of the biggest drivers of this pair to the upside during the trading session on Wednesday was the fact that the treasury auctions in the United States were strong, so therefore yields dropped. That gave permission for the dollar to start selling off again. This is a market that has been strong for quite some time so I believe that it makes quite a bit of sense that we would continue to see this market follow the same pattern that it has been in for quite some time. We are in a nice overall uptrend channel, and that is something that we should be paying close attention to.

If we did break down below the 50 day EMA, then I would be looking at the 1.35 handle for the next potential buying opportunity. That is an area that will attract a lot of attention in general, but I think at this point in time it is very unlikely that we will get down towards that area, so with that being the case I am looking to buy short-term dips and ride those out until we get to the 1.42 handle. If we can break above that level, then we can continue the longer-term uptrend, perhaps reaching towards the 1.45 level yet again. In time, I have no interest in shorting this market.