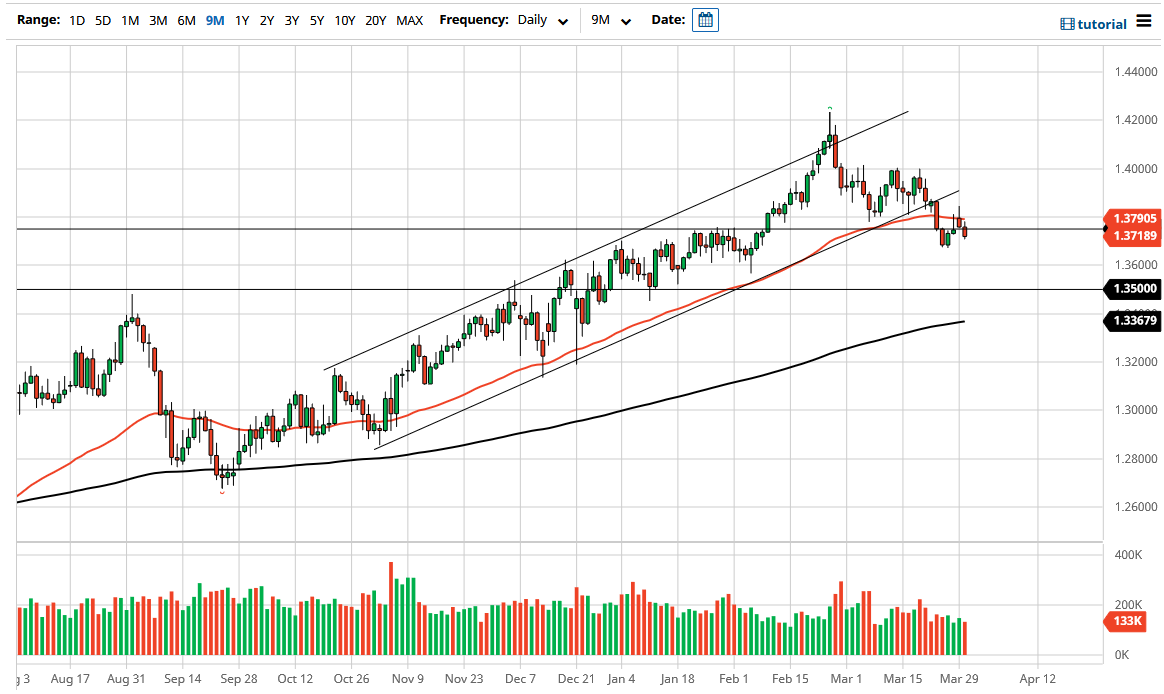

The British pound initially tried to rally on Tuesday but found the 50 day EMA to be a bit resistive again, just as it had on Monday. That being said, market is likely to continue rolling over, mainly due to the US dollar strengthening more than anything else. After all, this is a market that features a couple of relatively strong currencies, but without a doubt the big leader right now is the US dollar. Because of this, we have seen the British pound drop a bit. That being said though, it is relatively strong against most other currencies. That is why I know this is a story about the greenback itself.

The yields in America continue to rise, which of course drives up the value of the US dollar as people jump into the bond market. All things being equal, I do think that we could continue to drift lower from here, perhaps testing the lows from last week. Even if we were to break down below there, the market is likely to go looking towards the 1.35 handle underneath. This is an area that as previously been important and of course it is a large, round, psychologically significant figure. Beyond that, the 200 day EMA is starting to reach towards that area, and therefore I think it will add even more in the way of potential support.

The British pound has been strong in general due to the idea of the United Kingdom vaccinating 30 million of its population, at least the first half of the process. With that being the case, it is very likely that we will continue to see the British pound outperform others in the G-10, with the exception of the greenback. This is why I believe that even though we are going lower, that bad in general. Longer-term, I think somewhere around the 200 day EMA we will probably have an opportunity to get long. The 1.42 level above is a major resistance barrier, just as the 1.40 level is. This is a market that I think will continue to attract some supportive action, so once things start to turn around for the greenback, I will be a buyer. In the short term though, I believe that this is a market that you can use as an indicator for other markets as to what you should be doing with the dollar.