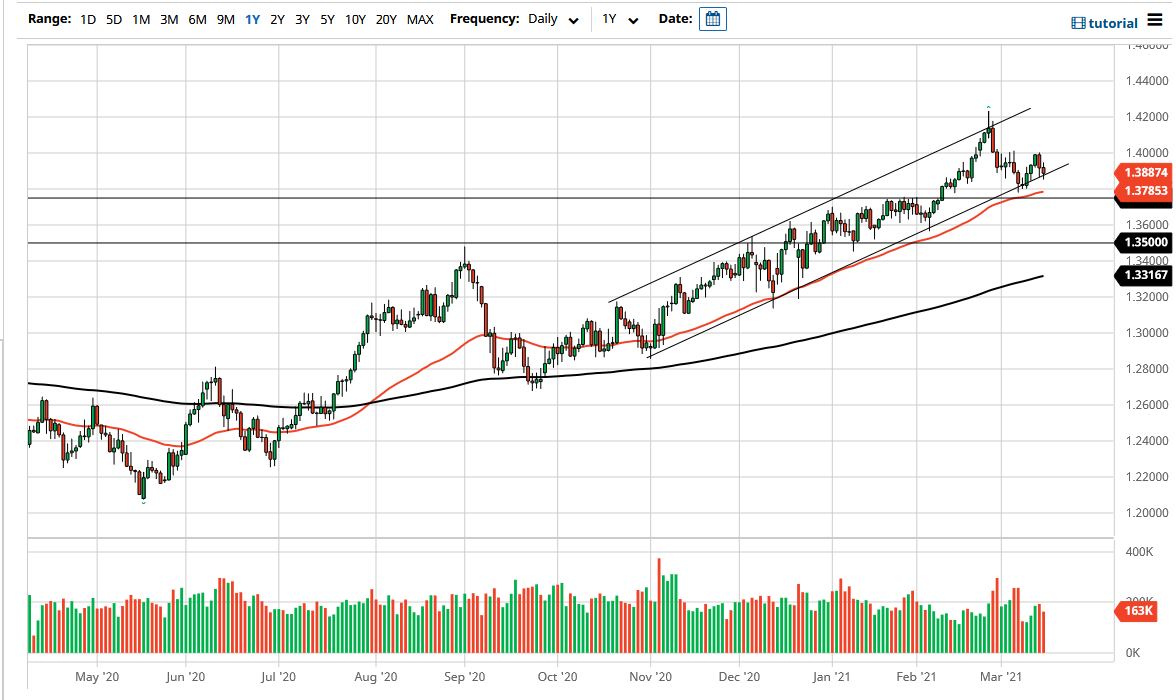

The British pound has gone back and forth during the course of the trading session on Monday, as we continue to see the uptrend line at the bottom of the channel offer a bit of support. That being said, the fact that we have not been able to continue to go higher it does suggest that there may be a little bit of trouble just above us. The 1.40 level of course is a large, round, psychologically significant figure, and we have seen selling they are more than once. If we can break above the 1.40 level, then it is likely that the market could continue to go back to the 1.42 handle, which is a massive resistance barrier that the market is currently paying close attention to. This can be seen on the weekly timeframe, and you can see that we formed a massive shooting star at the top of the channel when we reached that level.

To the downside, we not only have the uptrend line, but we also have the 50 day EMA that is coming into the picture as well, so I do think that there is a certain amount of support in this general vicinity. I think most of what we are going to see during the week is probably going to come down to what the central bank in America has to say about the yields rising, and with an FOMC policy statement and the question and answer session afterwards. In other words, people are going to be wondering whether or not the Federal Reserve is going to step in and do something about interest rates. If not, then that could see the US dollar strengthening again, due to higher interest rates in America.

In general, I believe that the 1.3750 level is a massive area that were paying attention to due to the fact that not only do we have the 50 day EMA there, but we also have previous resistance that should now offer support based upon “market memory.” Even if we break down below there, then the 1.35 level underneath would be the next support level that I think a lot of people would be paying attention to. It is not until we break down below there that I think the market would be one that you can start selling.