Bearish View

Sell the GBP/USD and add a take-profit at 1.3832. The next target will be 1.3758.

Add a stop-loss at 1.3950.

Bullish View

Set a buy stop at 1.3950 and a take-profit at 1.4000.

Add a stop loss at 1.3900.

The GBP/USD pair has dropped for the fourth consecutive day as traders refocus on the stronger US dollar and low Treasury yields. It has dropped to 1.3885, which is 2.57% below the year-to-date high of 1.4245.

US Dollar Performance

The GBP/USD is falling mostly because of the performance of the US dollar. The US Dollar Index has risen by 0.20% from its highest level yesterday. In addition to the sterling, the dollar has risen by 0.35% against the British pound, 0.30% against the Canadian dollar, and 0.20% against the euro.

This performance is mostly because of the performance of US Treasuries. The yields on the 5-year, 10-year, and 30-year Treasuries have dropped substantially in the past two days. This is partly because investors are doubting whether the Senate will pass Biden’s $1.9 trillion stimulus package, after all Republicans in the House of Representatives voted against the deal.

Republicans argue that the package is too big and unnecessary. They also blame Democrats for putting some measures that are not related to the pandemic. Instead, they have proposed a $600 billion stimulus that will probably not pass.

The data released yesterday showed that the global manufacturing activity is still robust. In the UK, the Manufacturing PMI increased from 54.1 to 55.1 because of the rising optimism of the economy and lengthier delivery times. In the US, the Markit Manufacturing PMI fell to 58.6 while the ISM Manufacturing PMI increased from 58.7 to 60.8.

Today, the GBP/USD will react to the latest UK House Price Index (HPI) from Nationwide. Economists expect the data to show that house prices increased by 5.6% in February. There will be no major data from the US today. As such, investors will keep watching the activity in the bond market.

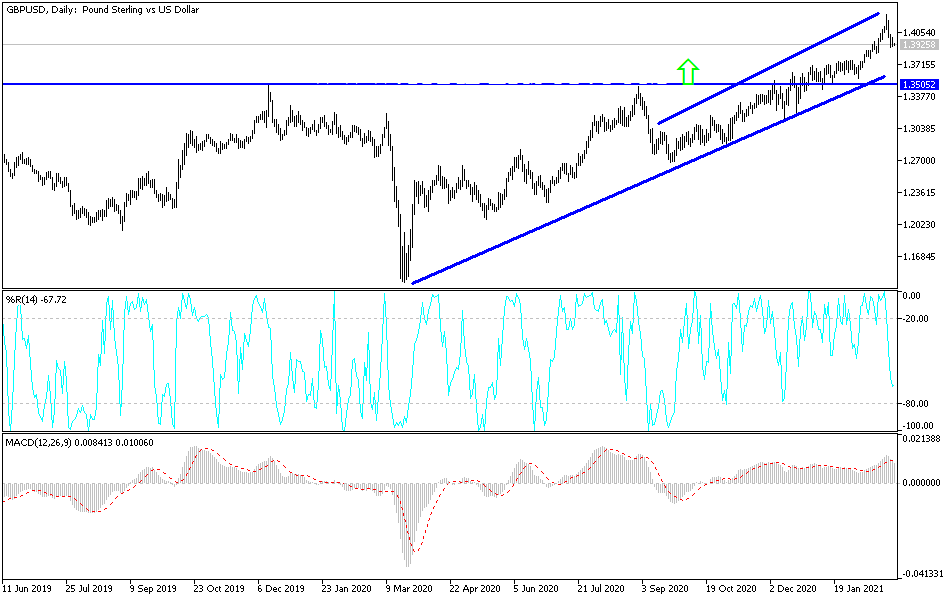

GBP/USD Technical Outlook

The GBP/USD pair declined to an intraday low of 1.3876 during the Asian session. This was the lowest it has been since February 18. On the four-hour chart, the pair has moved below the 15-period and 25-period weighted moving averages. (WMA).

Also, it has moved below the bearish pennant pattern that formed yesterday. Oscillators like the Relative Strength Index (RSI) have also continued to drop. Therefore, the pair may continue to drop as bears target the next supports at 1.3832 and 1.3758.