Bearish Signal

Set a sell-stop at 1.3672 (Wednesday low).

Add a take-profit at 1.3590 (S2 of pivot points).

Set a stop loss at 1.3780.

Bullish Signal

Set a buy stop at 1.3740 and a take profit at 1.3780.

Add a stop loss at 1.3650.

The GBP/USD is hovering near the lowest level since February 20th as investors focus on the falling US and UK bond yields and the mixed data from the UK.

Mixed UK Data

The UK published relatively mixed economic numbers this week. On Tuesday, data by the ONS showed that the country’s unemployment rate declined to 5.0% in January even after the government launched a major lockdown. Wages also rose, albeit slower than expected.

Yesterday, the UK published the relatively weak inflation numbers. The annual inflation rose by 0.4% in February after rising by 0.7% in January because of the falling clothing and auto prices as more people stayed at home. Core inflation rose by 0.9%, substantially below the previous month’s 1.4%.

On Friday, the ONS will publish the important UK retail sales numbers. Economists polled by Reuters expect the data to show that the overall retail sales fell by 3.5% in February after sinking by 5.9% in the previous month. Core sales are expected to fall by 1.5% from the previous 3.8%.

Yesterday, data by Markit revealed that the UK business activity has rebounded in March. The Flash Manufacturing PMI rose from 55.1 to 57.9, while the Services PMI rose from 49.5 to 56.8 as demand rose. In the United States, the two rose to 59 and 60, respectively. A PMI figure of 60 and above is a sign that business activity is expanding.

Later today, the GBP/USD will be affected by the final US fourth quarter GDP data. The median estimate is for the data to show that the overall economy expanded by 4.1% in the fourth quarter. Still, since this will be the final reading, the impact on the US dollar and the GBP/USD will be minimal.

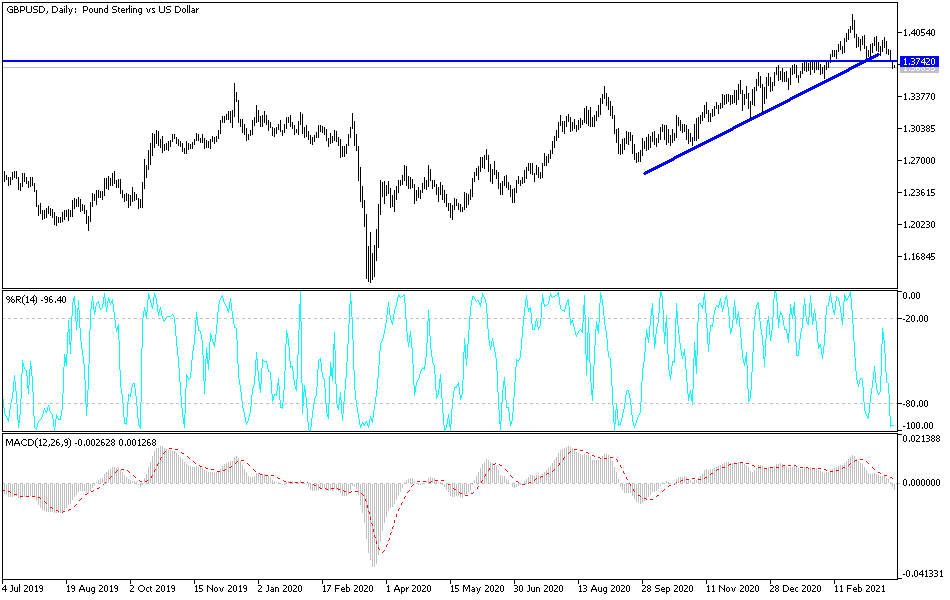

GBP/USD Technical Forecast

The four-hour chart shows that the GBP/USD is at an important support level. It is at the second support of the standard pivot points and is substantially below the important support at 1.3780. It has also moved below the 25-day and 50-day simple moving averages. The Relative Strength Index (RSI) and MACD have all continued to decline. Therefore, the pair may keep falling as bears target the third support at 1.3590, which is 0.85% below the current level.