Bullish View

Set a buy stop at 1.400 and a take profit at 1.4100 (slightly below R2).

Add a stop loss at 1.3950.

Bearish View

Set a sell-stop at 1.3950 (Wednesday low).

Add a take-profit at 1.3750 and a stop loss at 1.400.

The GBP/USD jumped in the overnight session after the Federal Reserve delivered a relatively dovish interest rate decision. The pair rose to 1.3977, which is slightly below the psychological level of 1.400.

Bank of England (BoE) Decision Eyed

In its March monetary policy meeting, the Fed left interest rates unchanged at the range of 0.0% and 0.25%. It also said that it will continue with its asset purchases in a bid to sustain the ongoing recovery.

The bank also upgraded the overall economic forecast from 4.2% to 6.5% because of the recent stimulus package and the faster vaccination drive. This will be the fastest economic recovery since 1983. It also expects that inflation will rise to 2.2% this year and then stabilize at 2.0% in 2020. The Fed also sees the unemployment rate dropping to about 4.5% from the current 6.2%.

The GBP/USD pair is now eying the upcoming Bank of England (BoE) decision that is scheduled for 13:00 GMT. Like the Fed, analysts believe that the BoE will leave interest rates unchanged at 0.10%. It will also leave the target of the quantitative easing program unchanged at 875 billion. It will also likely upgrade the UK economic forecast because of the faster roll-out of the vaccine.

The BoE decision comes at a time when UK numbers have been relatively strong because of the government programs. For example, the unemployment rate is at about 5.0% because of the extension of the furlough program. Business activity has also resumed in most places while the number of new infections has dropped.

In addition to the BoE, the GBP/USD will react to the US initial jobless claims numbers. Economists expects the data to show that the initial jobless claims fell from 712,000 to 700,000 last week. Continuing claims are expected to fall from 4.14 million to 4.0 million. Other important numbers will be the Philadelphia Fed Manufacturing Index. Analysts expect the index to fall from 23.1 to 23.0.

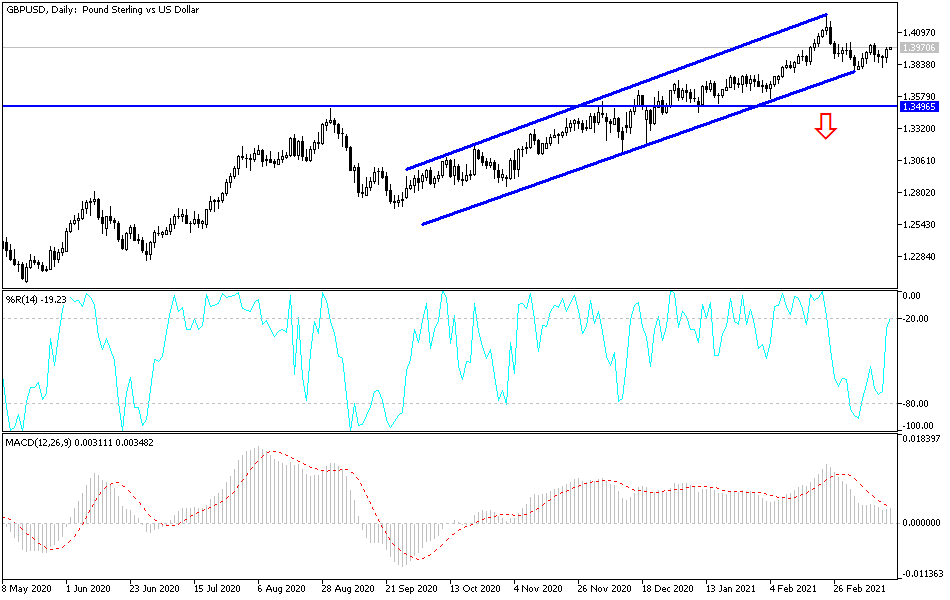

GBP/USD Technical Outlook

The GBP/USD price rose in the overnight session after the dovish Fed decision. On the four-hour chart, the price is slightly below last week’s high of 1.4000. It is also slightly above the 25-day exponential moving averages (EMA). The price is also slightly below the first resistance level of standard pivot points. Therefore, the pair will likely keep rising ahead and after the BOE decision. If this happens, a move above 1.400 is possible. On the flip side, a drop below 1.3853 will invalidate this trend.