Bullish Signal

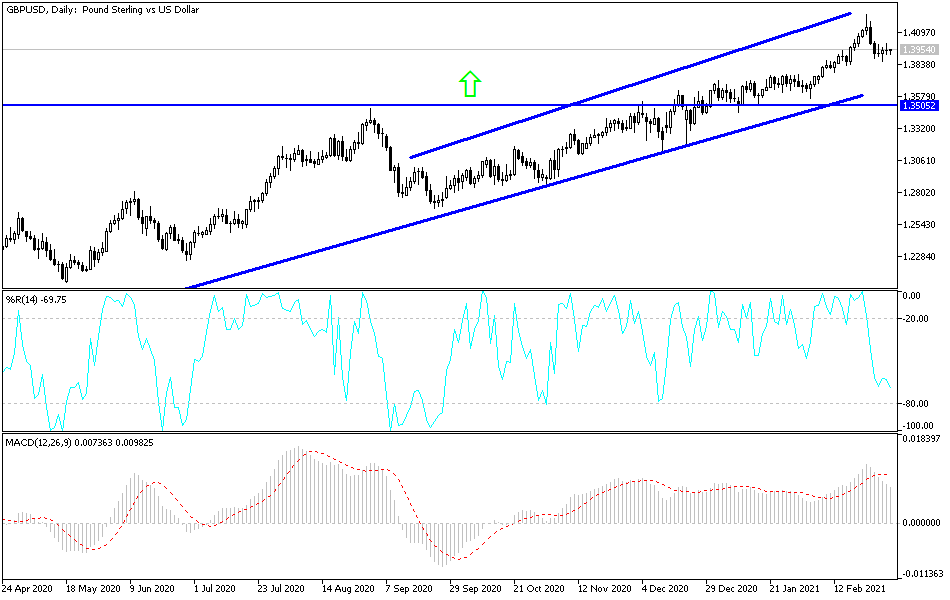

Place a buy limit order at 1.3900.

Add a take-profit at 1.4000 and a stop loss at 1.3856.

Timeline: 1-2 days.

Bearish Signal

Place a sell-stop at 1.3856 and a take-profit at 1.3800.

Add a stop-loss at 1.3900.

The GBP/USD price came under pressure in the overnight session after the weak ADP employment numbers and Rishi Sunak’s budget speech. The pair dropped to 1.3920, which was 0.60% below the highest point yesterday.

UK Budget and US Employment Numbers

Rishi Sunak, UK’s Chancellor of the Exchequer delivered this year’s annual budget yesterday. In it, he announced that the government would extend the furlough program until September. This means that the country’s unemployment rate will remain below that of its peers. In the program, the government is paying 80% of the salaries of the furloughed employees.

The government will raise the corporate tax to 25% in 2023, the first hike in 25 years. Also, it will provide 5 billion pounds to high street and companies in the hospitality industry to help them deal with the pandemic. Further, it will extend the stamp duty for three months. In total, analysts expect that the budget will lead to more government debt.

The speech came a few hours after Markit published relatively weak Service PMI numbers. In total, the PMI increased from 39.5 to 49.5, which was lower than the expected 49.7. The Composite PMI rose to 49.6. Later today, the company will publish the important Construction PMI.

The GBP/USD also reacted to the weak ADP jobs numbers from the United States. The company said that US private employers created 117,000 jobs after creating 195,000 in the previous month. This decrease was worse than the median estimate of 177K. The data came two days before the official jobs data by the Bureau of Labour Statistics. In the past, data by ADP and BLS tend to have a significant gap. Later today, the BLS will publish the initial jobless claims numbers.

GBP/USD Technical Outlook

On the four-hour chart, the GBP/USD has found substantial resistance at the first support of the Andrews Pitchfork tool. The pair is also along the middle line of the Bollinger Bands. Also, it has formed an inverted head and shoulders (H&S) pattern.

Therefore, it may continue to drop to complete the right shoulder and then bounce back. A complete upward reversal will be confirmed when the pair manages to move above the median pitchfork level at 1.4135. If this happens, the pair may move to retest the year-to-date high of 1.4245.