Wednesday’s GBP/USD signals were not triggered as there was no bearish price action when the price first hit the resistance level identified at 1.3902.

Today’s GBP/USD Signals

Risk 0.75%.

Trades may only be entered prior to 5pm London time today.

Short Trade Ideas

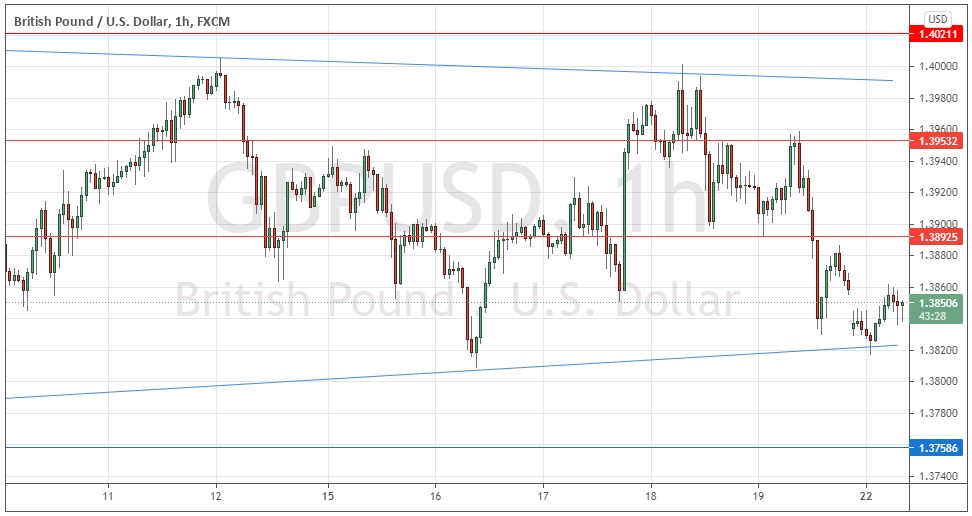

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3893 or 1.3953.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of the ascending trend line shown in the price below sitting at about 1.3823 or 1.3759.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote last Wednesday that the technical picture was a medium-term narrowing consolidation between 1.3800 and 1.4000, as evidenced by the narrowing trend lines. Over the shorter term, the picture remained bearish.

I thought that if either 1.3902 and 1.3947 was broken and the price held above it for a couple of hours, that would be a bullish sign.

This was not a great call, as the price did get established above 1.3902 and then sold off over the rest of the session, however the price did then rise later to get above 1.3947.

I was more correct about the medium-term consolidation, with the price chart below showing that the narrowing trend lines which I had drawn continue to hold the price, with the range continuing between 1.3800 and 1.4000.

There is no reason to think this range will be broken, as the price seems to have made a bullish bounce at the lower boundary area. It is likely to continue upwards but only weakly so, for a while.

I think the development to watch for here would be a sustained break below the lower trend line currently sitting at about 1.3823. If we get two consecutive hourly closes below that trend line today, we will be likely to see a further downwards move, towards the next support at 1.3759.

There is nothing of high importance due today regarding either the GBP or the USD.