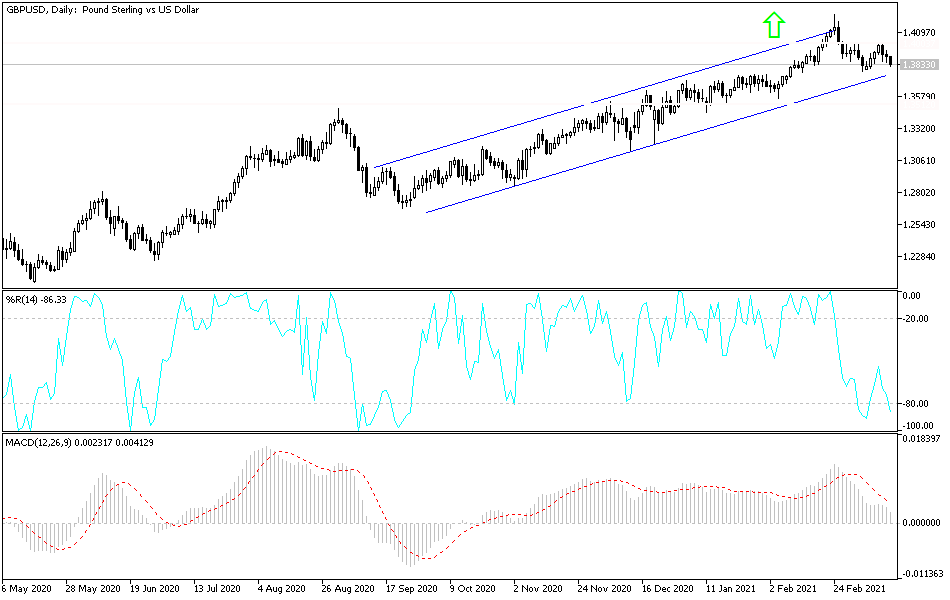

Bearish View

Sell the GBP/USD pair and add a take-profit at 1.3820 (61.8% retracement).

Add a stop loss at 1.3950.

Timeline: 1-2 days.

Bullish View

Set a buy stop at 1.3950 and a take-profit at 1.4000.

Add a stop loss at 1.3900.

The GBP/USD declined slightly in the overnight session as traders refocused on the upcoming US retail sales, industrial and manufacturing production, and the Federal Reserve interest rate decision.

US Retail Sales Data Ahead

The GBP/USD declined mostly because of the strong dollar as the US Treasury yields retreated. The yield on the ten-year government bonds declined to 1.59% from Friday’s high of above 1.60%.

Similarly, the 5-year and 30-year bond yields declined as traders waited for the Fed decision set for tomorrow. Economists expect the Fed will leave interest rates at the range of between 0% and 0.25%.

Like the European Central Bank (ECB) did, the Fed will also leave its quantitative easing policy unchanged. In the previous meetings and statements, Jerome Powell has said that the bank will likely continue with its easy-money policies even when inflation rises to the 2% target.

The GBP/USD is also easing ahead of the vital US retail sales numbers that will come out in the afternoon session. Analysts polled by Reuters expect the data to show that the overall retail sales declined by 0.5% from January to February. The sales had jumped by 6.0% in the previous month because of the stimulus package.

They also expect the core retail sales declined by 0.1% in February. Still, economists believe that the retail sector will be vibrant in the next few months because of the recently-passed stimulus package.

Later on, the Bureau of Statistics will also publish relatively modest manufacturing and industrial production data. These numbers will come a day after China said that the two production numbers rose by more than 30% in February.

The GBP/USD is also reacting to the relatively positive economic outlook by Andrew Bailey, the Bank of England (BOE) governor. He predicted that the economy will continue to rebound, pushing inflation above 2.0%.

GBP/USD Technical Outlook

On the three-hour chart, the GBP/USD pair formed a double-top pattern at 1.4014. Since then, it has declined by about 1% to the current level of 1.3867. The price is between the middle and lower lines of the Bollinger Bands while the Relative Strength Index (RSI) has moved close to the oversold level. It has also moved slightly below the 50% Fibonacci retracement level. Therefore, the pair may continue falling as bears target the 61.8% retracement at 1.3820.