Bullish View

Buy the GBP/USD ahead of UK GDP data.

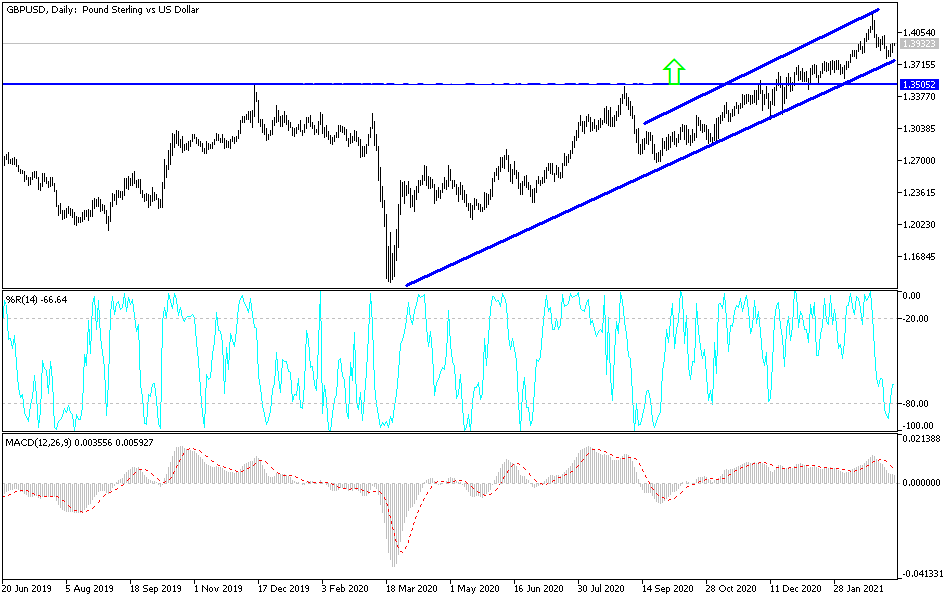

Set a take profit at 1.4015 and stop-loss at 1.3850.

Timeline: 1 - 2 days.

Bearish View

Set a sell-stop at 1.3850 and a take-profit at 1.3800.

Add a stop loss at 1.3900.

The GBP/USD rose slightly after the latest US inflation numbers and ahead of the final reading of the UK Q4 GDP data. The pair rose to 1.3943, which is 1.15% above last week’s low of 1.3778.

Sterling Tilts Upwards

The Bureau of Labour Statistics published inflation numbers that were mostly in line with estimates. The Headline CPI increased from 0.3% to 0.4% on a month-on-month basis and from 1.4% to 1.7% on a year-on-year basis.

This increase was not as dramatic as most analysts were expecting. Indeed, the yields on the ten-year US government bonds fell from above 1.55% to 1.53%. Still, with the next stimulus set to be signed, there is a possibility that the overall rate of inflation in the US will soar in the near term.

The GBP/USD is rising ahead of key economic data from the UK set for tomorrow. The Office of National Statistics (ONS) will publish the final UK GDP figure for the fourth quarter. Last month, data by the bureau said that the economy slumped by 9.9% in 2020. It also avoided a technical recession in the fourth quarter. It rose by 1.2% in December after slumping by 2.3% in November. However, since this is the third reading, the impact on the GBP/USD will likely be limited.

The ONS will also publish the latest manufacturing and industrial production numbers. In total, analysts in London expect the data to show that the overall industrial production fell by 4% in January while manufacturing production declined by 3.6%. The ONS will also publish the latest construction output and trade numbers.

GBP/USD Technical Forecast

The four-hour chart shows that the GBP/USD price has been rebounding after falling to 1.3776 last week. The price has also formed an ascending channel. It has also moved above the 15-period and 25-period exponential moving averages. The price is also slightly below the upper line of the Bollinger Bands while the slow and fast MACDs have moved above the neutral line. It has also risen above the Ichimoku cloud, which is a bullish thing.

Therefore, the pair will likely keep rising, with the next key target being the March 4 high of 1.4015. However, a drop below 1.3843 will invalidate this prediction.