The GBP/USD lost all its upside correction gains during last week's trading, which had hit the 1.4240 resistance level, the highest in three years. The retreat reached the 1.3888 support level before closing trading around the 1.3927 level. The pair's losses were supported by risk appetite and even the global stock markets, which have always been the momentum for the sterling's recent gains. The UK's vaccination progress compared to global economies has boosted the pound significantly in recent months. The pound is expecting the announcement of the details of the country's budget this week.

Andrew Goodwin, Chief Economist in the United Kingdom at Oxford Economics, said: “The roadmap to easing restrictions strengthened our view that the UK would be one of the strongest performing economies among advanced economies. This week's budget means that the UK has to be one of the strongest performing economies this year. Our latest forecasts are broadly in line with the road map and show a GDP growth of 5.5% in 2021, a performance we only expect the United States of America, Singapore and Spain to improve.”

This comes before the announcement of the budget details from British Finance Minister Rishi Sunak on Wednesday, which is the most important event in the British economic calendar. Speculation that points to a combination of financial support and the announcement of potential tax hikes may be politically controversial but is not likely to encounter opposition from the markets.

Britain has the highest number of deaths due to the virus in Europe, with nearly 123,000 people dead.

Bank of England Chief Economist Andy Haldane said that UK inflation is likely to rise significantly in the coming months, a comment that has led to a rise in the return on UK government revenues and a rebound in the value of the pound, which has come under intense selling pressure during the recent period. UK 10-year Treasury yields rose to their highest levels since March 2020 at 0.823%, up 4 basis points the day after Haldane's speech. The rise in UK yields was supported by additional comments by Haldane that there is a risk of the BoE being complacent, allowing “inflation cats out of the bag”.

As is well known, global central banks tend to respond to high inflation by raising interest rates. While high growth should be good news for the markets, we currently live in a world where market valuations have been largely driven by the massive expansion of the balance sheet at global central banks, which has created liquidity that has found its way into equities.

The British pound suffered from high US bond yields over the last few hours, but the counter-rise in UK yields may offset some of these losses.

The British pound rallied sharply in the Forex market in early February after the Bank of England signaled that it was not considering cutting interest rates again, and Haldane's comments indicated that investors may need to look for a rate hike earlier than they expected.

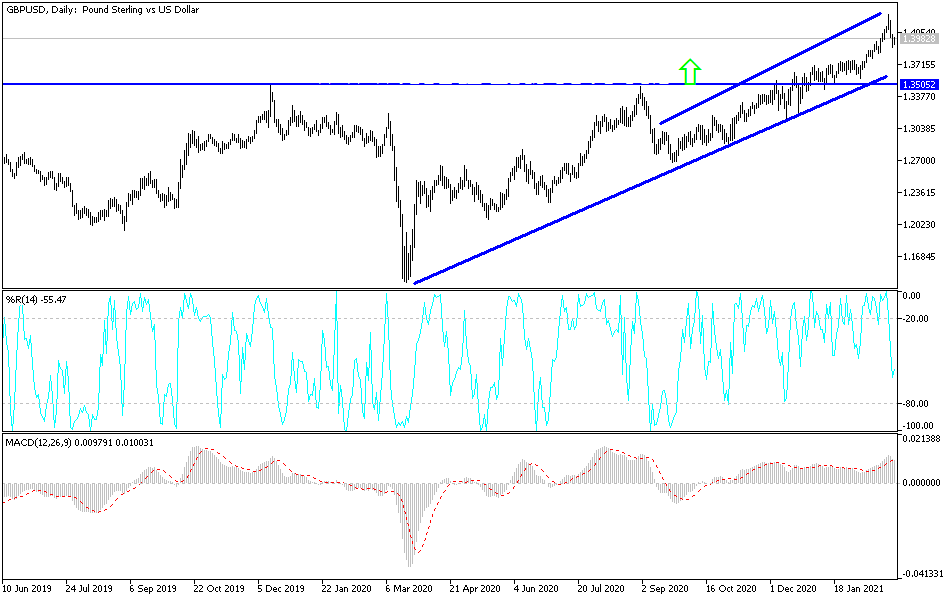

Technical analysis of the pair:

I still prefer to buy the pound from every dip, and the most relevant support levels for the GBP/USD are currently 1.3880, 1.3790 and 1.3700. On the upside, it must be emphasized that the pair's stability above the 1.4000 psychological resistance will continue to support the bulls to launch the currency pair on the bullish path followed for five months in a row.

Today's economic calendar:

From Britain, the Industrial Purchasing Managers Index reading, net lending to individuals, money supply and mortgage approvals will be announced. Then the announcement of the US ISM Manufacturing PMI reading and the US Construction Spending Index will be published.