The GBP/USD pair has been giving a bullish performance for three trading sessions in a row, with gains that reached 1.3935 at the time of writing. The recovery of the US dollar was the reason for the pair's retreat to the support level of 1.3777 at the end of last week’s trading, its lowest level in a month. At that time, we mentioned that buying the pair would be the best trading strategy, as the pound is still optimistic about the progress in the rate of vaccinations and easing COVID restrictions, which paves the way for a faster recovery.

The United States' chief infectious disease expert said that the country can take important steps towards returning to the normal situation it was in before the outbreak of the epidemic, even before the country reaches a herd of immunity from the virus. Anthony Fauci says the best estimates for when enough people are immune to end an outbreak range from 70-85% of the population - a figure that is expected in late summer or early fall.

He adds that with the escalation of the vaccination rate and the protection of those most vulnerable to the virus, some government restrictions can be lifted. "You don't have to wait until you have complete herd immunity to really have a profound effect on what you can do," Fauci said.

The price of the pair reached a new multi-month high in late February when it hit 1.4243, but a fall back below 1.40 raises questions about whether the pair has peaked now. Forex analysts at ING say now is not the time to lose bullish confidence in the GBP/USD pair, and this week they released a research update detailing how they believe the British pound is the best among the major G10 currencies.

As a result, strategic analysts at the Netherlands-based investment bank and lender say they expect the GBP/USD pair to rise significantly above current levels in the coming months. Chris Turner, Head of Forex research at ING in London, says: “Rapid vaccination and improved growth prospects in the UK have resulted in a full re-pricing of potential Bank of England cuts (in stark contrast to the European Central Bank) - which in turn benefited the pound sterling“

The UK budget announced in the first week of March is seen by ING strategists as being marginally positive for the pound as it extends the rental subsidy plan until September. British Finance Minister Rishi Sunak had announced a net gift in the short term that will see an additional 65 billion pounds in spending, grants and tax breaks, which means that the total spending and additional benefits available during the crisis is 352 billion pounds.

Adam Cole, Forex Strategist at RBC Capital Markets says, “According to our estimates, the UK has now provided more financial easing than any other country in the G10. A combination of tax cuts and spending increases has taken our estimates of total stimulus through 2020 and 2021 to 14% of GDP.” Meanwhile, the market is not believed to have exaggerated too much in the view that the British pound will outperform in 2021, which means that positioning will not necessarily be a headwind.

However, ING joined other analysts - at UBS, for example - in saying that the recent dollar rally is likely to be temporary and that the US dollar's downtrend will resume once the sell-off in US Treasury bonds subsides. They expect the GBP/USD price to reach a high of 1.50 this year.

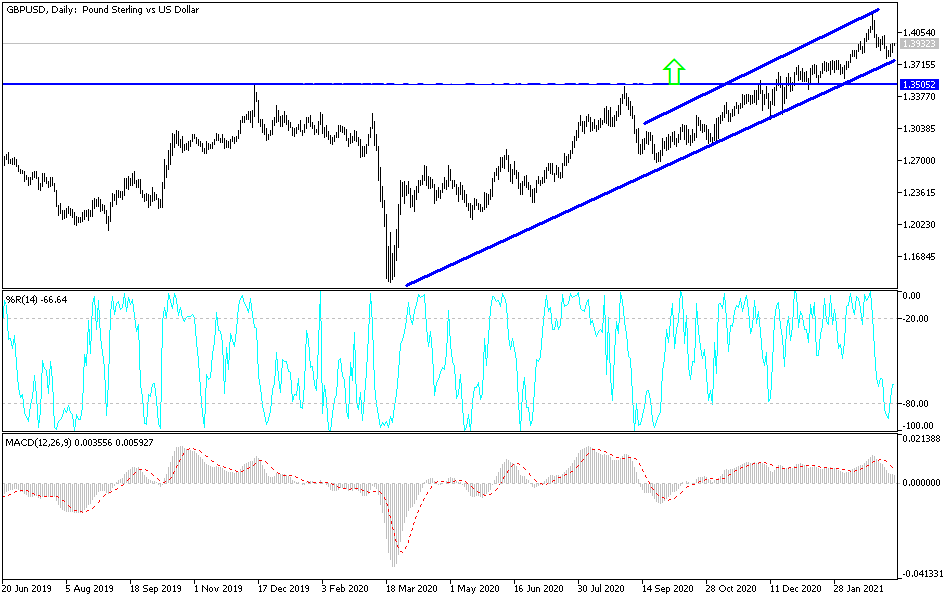

Technical analysis of the pair:

On the daily chart, the GBP/USD pair is trying to avoid a collapse below the lower line of the prominent ascending channel, and it appears that with the recent decline, it will be a base for launching higher again. The bulls' control will increase and buying will increase if the pair returns to stability above the psychological resistance 1.4000, which may push the pair to higher levels, the most important of which are 1.4085, 1.4165 and 1.4300. Still, I would prefer to buy the pair on every downside. The foundations and factors for the GBP's future gains are still strong and gaining momentum. The closest support levels for the pair are currently 1.3880, 1.3770 and 1.3600.

The economic calendar is still short on important British economic releases. Therefore, the US dollar will be affected today by the announcement of the number of weekly jobless claims.