Following the US Federal Reserve's policy decision, the GBP/USD pair is now awaiting the Bank of England's announcement of its monetary policy decisions. In the meantime, the GBP/USD succeeded in correcting up to the 1.3970 resistance level, where it is stable at the time of writing. The recent sell-off pushed the pair towards the support level at 1.3808, and we noted in recent analyses that any dip is a good buying opportunity, as the foundations supporting the pound's strength are still in place. All in all, the British pound may face additional volatility over the next 48 hours as investors trade around today's BoE event.

However, any sterling weakness is unlikely to last longer, as analysts believe that a correction in the increased market sentiment in the market on the pound is likely to have a role in the recent volatility.

UK interest rates will come under scrutiny today when the Bank of England presents its latest policy decisions and provides guidance on how to change that policy in the future.

The bank's monetary policy committee is not expected to change interest rates and is likely to be a sign that it has become more confident about the outlook for the British economy. This may encourage the market to provide its expectations regarding the timing of the rate hike in the bank, which in turn is considered supportive of the British pound.

On the other hand, some commentators in the Forex market have pointed the finger of blame on the news that the legal actions taken by the European Union against the United Kingdom on issues related to the borders of Northern Ireland were behind the decline of the British pound. However, the majority of analysts agree that this is not a long-term poignant story for the British pound given that the severe escalation of tensions and the potential imposition of trade tariffs by the European Union as punishment is likely to shift core balances already collected into a Brexit picture.

Optimism is spreading in the United States as COVID-19 deaths decrease and states are easing restrictions and granting vaccines to younger adults. But across Europe, panic is starting to spark another wave of infections that have shuttered schools and cafes and imposed new closures. The divergent pathways of the epidemic on the two continents can be partly linked to the most successful vaccine launch in the United States and the spread of the most contagious variants in Europe. However, health experts in the United States say, what is happening in Europe should be a warning against ignoring social distancing or giving up other safeguards too soon.

The United States recorded about 537,000 deaths overall, more than any other country. The daily death rate in the United States has dropped to an average of just under 1,300, down from a high of around 3,400 two months ago. New infections are reaching about 55,000 a day on average, after peaking at more than a quarter of a million a day in early January.

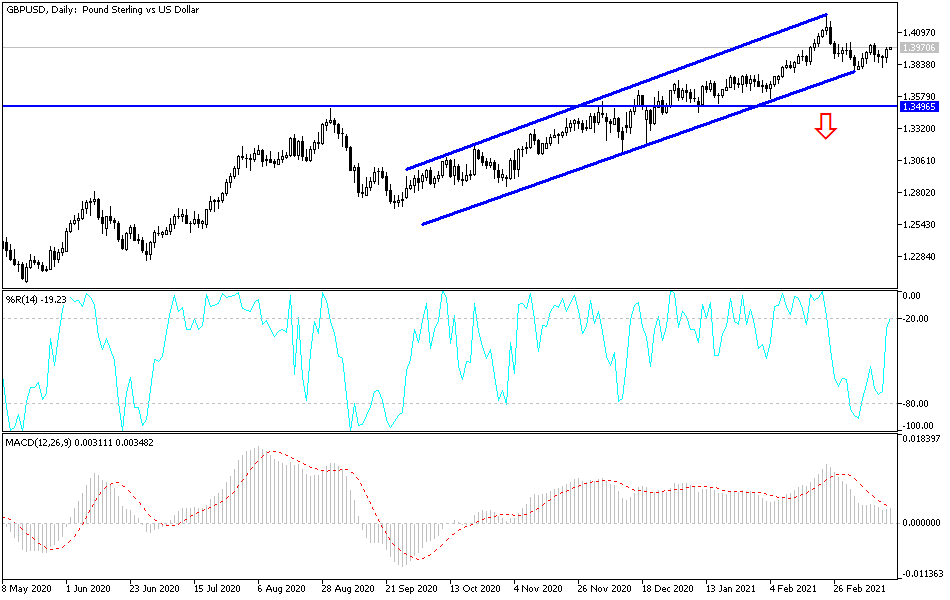

Technical analysis of the pair:

The bulls' control will increase the performance of the GBP/USD pair by stabilizing above the 1.4000 psychological resistance. which will bring the currency pair back to the middle of its ascending channel, which is still in place, and thus support more buying of the pair. If that happens, the next bullish targets will be 1.4085, 1.4140 and 1.4300. On the downside, I still see that moving below the 1.3800 support level will support the breach of the ascending channel according to the performance on the daily chart. I still prefer to buy the currency pair from every downside.

Today's economic calendar:

The Bank of England will announce its monetary policy decisions and the content of the meeting’s minutes to anticipate the future of the bank’s policy, especially in light of the UK's progress in vaccinations, which speeds up the pace of Britain’s economic recovery. From the United States of America, the number of weekly jobless claims will be announced and the Philadelphia Industrial Index will be released.