After the GBP/USD fell to the support level of 1.3777 at the beginning of this week's trading, its lowest in nearly a month, the pair actually began to rebound higher. The rebound's gains reached the 1.3925 resistance level before settling around 1.3890 at the beginning of trading on Wednesday. The UK's progress in vaccinations and the easing of restrictions, along with the provision of more stimulus, will continue to support the sterling's gains again. The pound sterling remained the best-performing major currency in 2021, while it recovered after ceding it to the dollar in light of what happened in the bond market, which fell with the start of this week.

Analysts believe that the improved economic outlook in the UK means that the pound may have more to gain in the Forex market later this year and thereafter. Commenting on this, Elias Haddad, Chief Foreign Exchange Analyst at CBA, said: “We now expect the British pound to gain significantly from the recent lows. Therefore, we look to buy the GBP/USD at current levels (1.3865), with a tight stop loss at 1.3720. Purchasing power parity is based on relative GDP deflators of around 1.5500. Second, the UK current account deficit is the smallest since the first quarter of 2012. This means that the British pound no longer needs to trade at a significant discount on its underlying balance to attract foreign savings.”

The early start of vaccination in the UK enabled it to outperform all other countries except the US and Israel while offering the economy an opportunity to re-open and recover ahead of others in Europe. But with the UK Treasury extending its emergency programs for months in last week's budget, the economy will also benefit from fiscal backwinds valued at double crosses of GDP as it reopens in the spring and summer.

As a result, Britain's economic growth is now widely expected to be among the fastest in the developed world this year, and market expectations for interest rates in the Bank of England (BoE) are on the rise, although a CBA analyst says the latter still has “room for higher adjustment in favor of the British pound”. Expectations have increased elsewhere recently, most notably the United States, where the heavy sell-off in the government bond market extended to other debt markets before eventually also leading to stocks and commodities rallies in the past few weeks.

Sean Osborne, Scotiabank's Chief Forex Strategist, says: “The pound's positives remain the same: vaccinations have been introduced faster than most, and the Bank of England may cut asset purchases at its March 18th meeting. These factors, as a whole, should continue to raise the value of the pound sterling against the rest of the currencies, especially if there is ambiguity about reopening economic activity early."

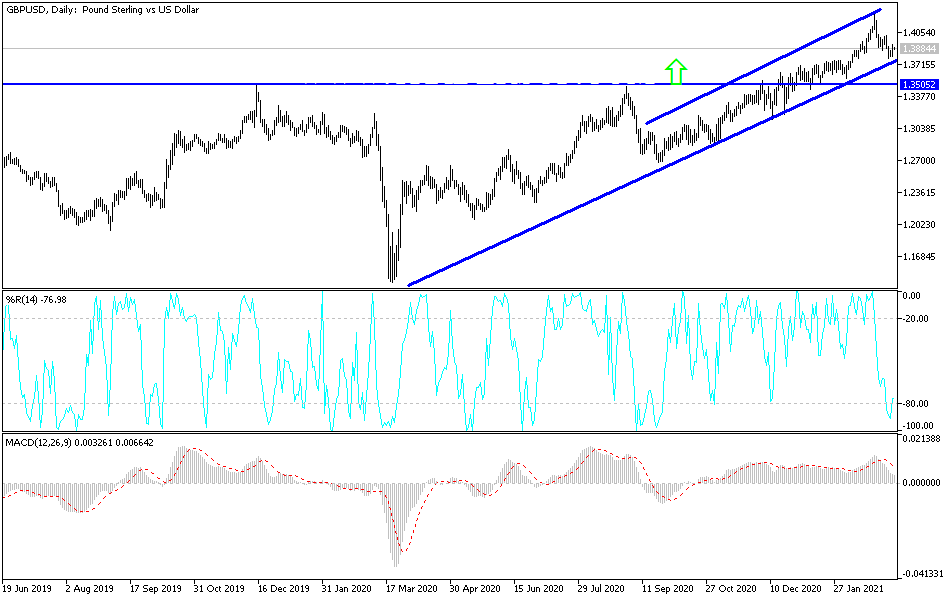

Technical analysis of the pair:

Despite the recent decline, the GBP/USD did not breach the lower line of the ascending channel on the daily chart. I believe that a breakout and stabilization above the psychological resistance 1.4000 will be important for the bulls to start taking moving towards stronger bullish levels. This is taking into consideration that moving towards the support at 1.3800 will breach the lower line of the channel shown on the chart, and thus selling will increase again. I would still prefer buying the pair for the above reasons.

As is the case since the beginning of trading this week, the currency pair does not expect any important British data. The focus will be on US inflation figures, with the release of the Consumer Price Index.