The GBP/USD pair is nearing the lower line of the ascending channel amid profit-taking, with the recovery of the US dollar reaching the support level of 1.3777, a 2-month low. The pair tried to rebound higher during last week's trading, but its gains did not exceed the psychological resistance level at 1.4000, as It returned to stability and closed trading flat around 1.3918. The currency pair was affected by another explosion in the US bond market, which seemed to inspire the profit-taking that hit most risk currencies. Expectations are still growing that the currency pair may stabilize above 1.4000 psychological resistance until the Bank of England announces its monetary policy later this week.

These expectations could be particularly strong and likely if the Bank of England does nothing to dampen the recent developments in the bond market, or confirm that in its March policy decision next Thursday, which is this week's major domestic event for the British pound.

British government bond yields have recently increased alongside US and other global bonds, though it is unlikely that the Bank of England will protest against this. Higher yields are a natural consequence of the combination of recovery playing a role in an economy that has not had much trouble achieving its 2% inflation target in recent years, and it doubly supports the GBP/EUR in the current environment where the ECB was only last week taking action to prevent Eurozone revenues from rising too much.

Both the Bank of England and the markets have recently expressed confidence that UK inflation will easily return to the 2% target or even higher over the coming years, and expectations also indicate that the bank is expected to raise interest rates from the historically low 0.1%. This is a fundamentally supportive development for the British pound and is unlikely to be dampened by the Bank of England, as both the rise in bond yields and the resulting increases in sterling exchange rates provide policymakers with some form of insurance against any potential overshooting of the inflation target in the coming years.

“The decline in GDP for January was much less than we feared,” says Andrew Goodwin, Chief Economist in the United Kingdom at Oxford Economics. "We have noted regularly that the consensus forecast for 4.4% GDP growth for 2021 is very weak and that the addition of potential reinforcement from easing restrictions to the higher starting point will drive our new projections. Adjustments to health outcomes to integrate testing, tracking and vaccination plans provided a major boost. But there was also evidence of greater resilience across large parts of the private sector.”

Accordingly, Britain is widely expected to be among the fastest-growing countries in the developed world this year thanks to the vaccinations, and continued substantial public support for the economy through the British Treasury. These factors fuel the confidence of the Bank of England and financial markets that the UK inflation target will be met immediately, making the Bank of England likely one of the first global central banks to start raising interest rates and “normalizing” their monetary policy settings over the coming years.

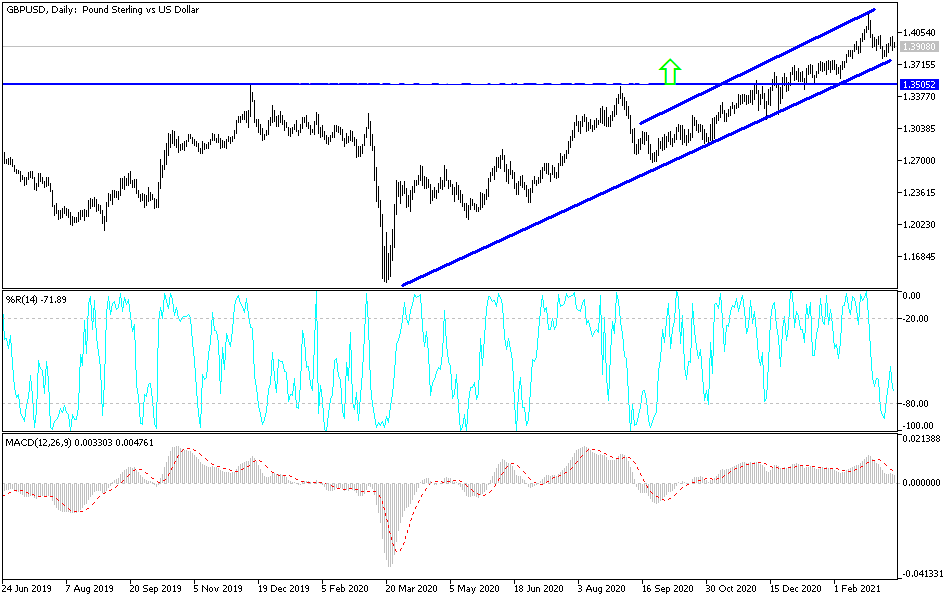

Technical analysis of the pair:

Despite profit-taking for two weeks in a row, the GBP/USD pair did not exit its bullish channel and remained stable around and above the 1.4000 psychological resistance, which increased the desire of Forex investors to buy the currency pair. Consequently, the pair launched to stronger bullish levels, as happened at the end of last month's trading. On the downside, a breakout of the bullish channel will occur with a breach of the support level at 1.3700. All in all, I still prefer to buy the currency pair at every dip.