The pound is trying to withstand the recent strength of the US dollar, supported by investor optimism towards the pace of British vaccinations. In Tuesday's trading session, the GBP/USD made a bearish move to the 1.3777 support level before settling around the 1.3846 level as of this writing. Analysts and economists still believe that the British economy is well prepared for an economic recovery in the coming weeks and months, with the March budget announcement supporting this view.

Last week, British Finance Minister Rishi Sunak unveiled the British government's spending and tax plans and surprised economists with more generous support packages in the near term. Before that, the British government announced a timetable for abandoning all COVID restrictions, which would pave the way for a normal life as soon as possible. This contrasts the uncertainties in the US, which still leads world figures in terms of the number of infections and deaths in the epidemic.

"The British economy is well positioned for the upcoming recovery," says Zach Bandel, economist at Goldman Sachs. He added that "the subsidy program put in place by the government surprised the unanimous expectations on the upside, and included a number of economic incentives targeting medium-term investment."

Most economists argue that providing generous support to economies during the COVID-19 crisis is likely to reduce any long-term scars and allow for a more robust recovery. For currencies, generous fiscal support in the near term is thus a levering incentive. Goldman Sachs’s analysis shows that the additional spending announced by the British government comes after substantial financial support in 2020 has already contributed to British households accumulating "excess savings" close to 10% of their annual spending before the epidemic. This, they say, puts the UK just behind the US and "a little more than the Eurozone".

Recently, global markets have struggled under the weight of the recent rise in sovereign bond yields, especially the rise in long-term bond yields. This has increased the cost of financing in the global economy and investors are concerned that development will stifle the global economic recovery, before it has a chance to start. As a result, equity markets have lost many of their record gains since late February, and so have those currencies that are positively in line with market sentiment.

The British pound has shown a strong correlation with global market sentiment, especially against the dollar.

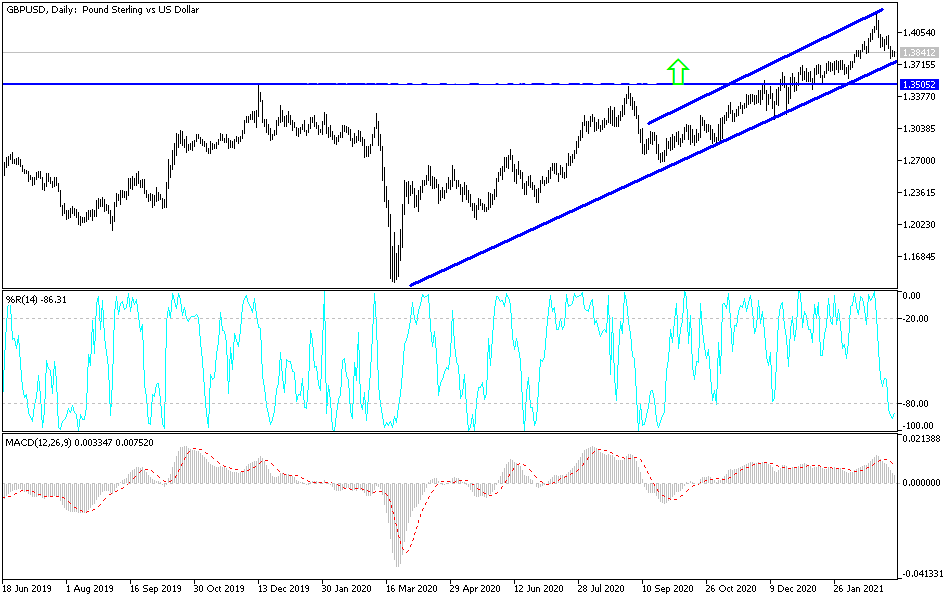

Technical analysis of the pair:

The recent performance of the GBP/USD pair confirms that the pound is only waiting for the momentum to launch to the top and regain its recent losses. The breach of the 1.4000 psychological resistance is important for the return of the bulls' control and thus a breakout to stronger bullish levels and exit from the last descending channel formation. I still prefer buying the pair from every downside level, and the closest buying levels are currently 1.3790, 1.3700 and 1.3630. Progress in vaccinations and easing restrictions will revive the British economy at a faster rate than what is happening in the United States of America, not to mention the return of global stock market gains and investor risk appetite.

For the second consecutive day, the currency pair does not expect any important US or British economic data.