For four trading sessions in a row, the GBP/USD has stabilized in limited ranges between the 1.3858 support level and the 1.4026 resistance level, settling around 1.3950 as of this writing. This technical performance heralds that a strong and violent movement in one direction will take place. I see that the upside opportunity is still the strongest, as the pound is still receiving the attention of the markets due to Britain's progress in vaccinations, and it is the closest to a complete re-opening and thus a rapid economic recovery. Divergent opinions and expectations about the content of the important British budget, which was announced yesterday, was the reason for the strong reaction of the pound in the Forex trading market to the announcement.

In general, the pound sterling maintained its gains against the euro, the dollar and most major currencies after the announcement of the 2021 budget, which saw the negative impact of the tax increase on companies somewhat supported by other pro-business initiatives. Chancellor of the Exchequer Rishi Sunak told Parliament that the corporate tax would rise by 6% in 2023, thus eliminating Britain's post-Brexit competitiveness in this area. The Office of Budget Responsibility (OBR) says planned tax increases will increase the UK tax burden to the highest level since the late 1960s, with the tax burden rising from 34% to 35% of GDP in 2025-26.

However, the pessimism from the announcement was countered by the increase applied only to profits in excess of £50,000 which means that only 30% of companies are likely to be affected according to the Treasury Department's estimates. The surprise came when Minister Sunak announced a "super discount" on business investments that would allow companies to reduce their tax bill by 130% of the investment cost.

Accordingly, the Office of Budget Responsibility (OBR) says the move will boost investment by 10%, or 20 billion pounds more per year. Sunak said this is the "largest business tax cut in recent British history".

Commenting on the announcement, Veraj Patel, Forex strategist at Vanda Research says, “The unreported parts of the UK budget are pro-growth/pro-investment. Roughly speaking, this budget makes it more acceptable to Forex investors than direct incentive checks as is the case in the United States. In general, it is a profitable budget for the British pound.”

The pound to euro exchange rate rose 0.40% following the budget announcement at 1.1590 while the pound to dollar exchange rate rose 0.10% at 1.3963. The pound rose against all of the other major currencies, with the largest gains against the Australian dollar and Swiss franc.

The budget was a net short-term giveaway that would see an additional £65 billion in savings, which means that the total spending and additional benefits saved during the crisis is £352 billion.

The latest batch of forecasts for the UK economy from the Office of Budget Responsibility show that the economy will contract by 9.9% in 2020 instead of the 11.3% expected in the bureau's November forecast. The new projections show that the economy is now seen recovering before the spread of the coronavirus by mid-2022, six months earlier than expected in November.

The projected growth is 7.3%, which will be the strongest growth of the British economy in 80 years.

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the GBP/USD is trading within a bearish channel formation. It has now fallen to trade below the 38.20% Fibonacci level. It continues to trade near the overbought levels of the 14-hour RSI. Accordingly, the bulls will target short-term rebound gains around 1.4007 or higher at 1.4080. On the other hand, the bears will be looking to extend the current downside towards 50% and 61.80% Fibonacci at 1.3901 and 1.3822.

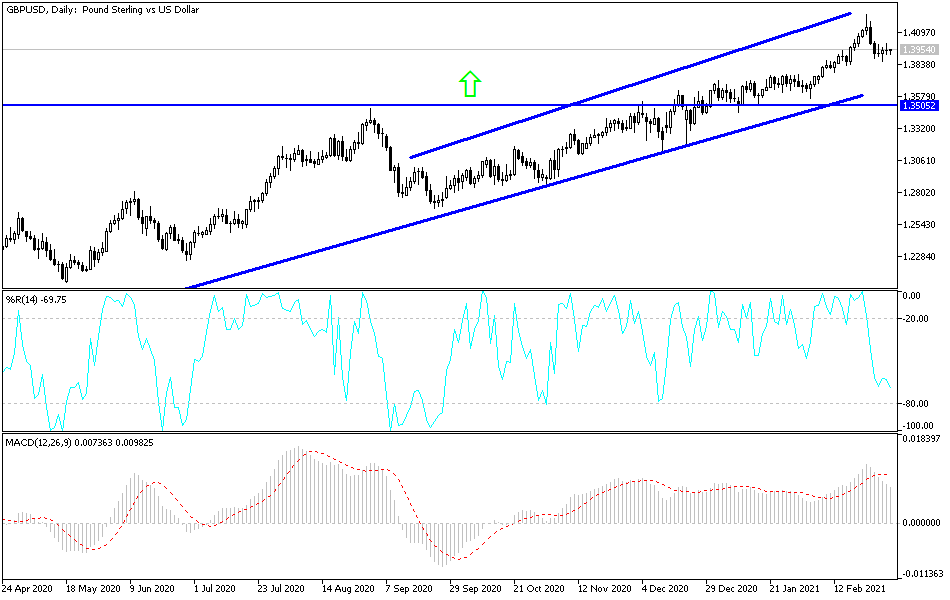

In the long term, and based on the performance of the daily chart, it appears that the GBP/USD is trading within a bullish channel formation, which indicates significant long-term bullish momentum in market sentiment. The recent pullback from the 14-day RSI overbought levels pushed it into the normal trading zone. Accordingly, the bulls will target long-term gains around 1.4168 or higher at 1.4381. On the other hand, the bears will be looking to pounce on a dip around 1.3757 or below 1.3537.

The pound will be affected today by the performance of global stock markets and the announcement of the Construction PMI reading. The US dollar will be affected today by announcements of weekly jobless claims, non-farm payrolls and statements of US Federal Reserve Chairman Powell.