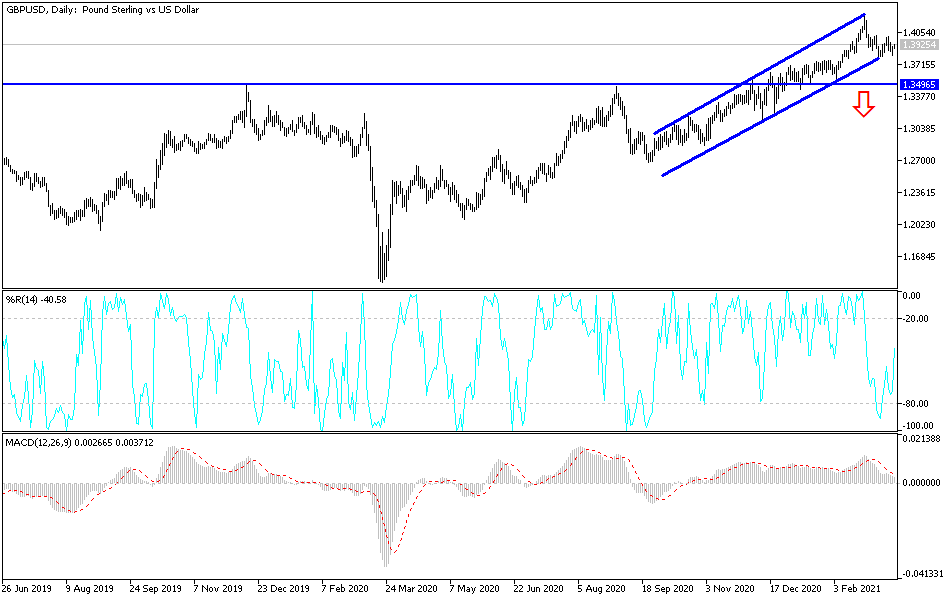

The bears have been trying to push the GBP/USD pair to breach the 1.3800 support level and exit the sharp bullish channel that has been affecting its performance for some time. The pair holds around 1.3915 at the time of writing, ahead of the US Federal Reserve policy decisions and Chairman Jerome Powell's remarks. The bulls gained some momentum after the disappointing US retail sales numbers were released, which is a strong indication of the extent of US consumer confidence and consumer spending, which accounts for 70% of US economic activity.

US retail sales fell -3% last month when expectations were of a drop of only 0.5%, which was more than enough to offset a large bullish revision to the previous estimate of a 5.3% increase for January. "Weather conditions affected activity after the spending increase in January," said Catherine Judge, an economist at CIBC Capital Markets. "With bad weather in the rear-view mirror, it is expected that the coming months will witness an acceleration in consumer spending as services continue to reopen and additional financial incentives arrive.”

Today, the FOMC decision may affect the dollar’s price movement strongly in the upcoming trading sessions, especially if US monetary policy makers turn to a more hawkish tone. Although Fed Chairman Powell had previously emphasized that the increase in bond yields is not a cause for concern and that this indicates a strong recovery in the US economy, a hint that they are still open to price adjustments or asset purchases to maintain cover on yields may be more bullish for the US currency.

The British pound is one of four currencies in the G10 that are still holding on to their year-to-date gains against the US dollar (the Canadian dollar, the Norwegian krone and the Australian dollar are the other three currencies).

As is the case since the beginning of trading this week, there are no major economic reports to be released from the UK, although the British pound was on a strong footing due to the success of the vaccination efforts in the country. The main catalyst for the pound will be the Bank of England's decision and the MPC meeting minutes later this week, although there have been no actual interest rate changes either. However, a more optimistic tone from the Bank of England may be sufficient to stimulate the GBP/USD to break higher, especially as the pair is in an uptrend on the long-term charts.

The price of the GBP/USD currency pair formed low highs and lows for trading within a descending channel on the hourly chart. The price is testing the resistance and may be due for a return to the bottom of the channel at 1.3800 support. Overall, the 100 SMA is still above the 200 SMA, confirming that the overall trend is still up. In other words, there is a possibility that the resistance may be broken. The price is testing the dynamic resistance at the 200 SMA and may still hit a barrier at the dynamic 100 SMA inflection point.

Stochastic is still heading lower to indicate selling pressure, so the price may follow suit. The RSI is also heading lower without reaching an overbought zone, indicating that the bears are eager to return. I still prefer to buy the pair from every downside level, as the long-term basis of the GBP gains is still the strongest.