Gold markets have been absolutely hammered of the last several months, and unfortunately it does not look like April was going to be much better, at least not initially. The US dollar has been like a wrecking ball for precious metals, as demand for greenbacks continue to climb. The yields in America continue to rise, and as I write this article the 10 year Note is currently yielding 1.76% going forward. It is a simple matter of whether or not investors would rather clipping a coupon, or pay to store massive amounts of gold? It is a pretty straightforward answer when the yield in the bond market is paying you a real rate of return.

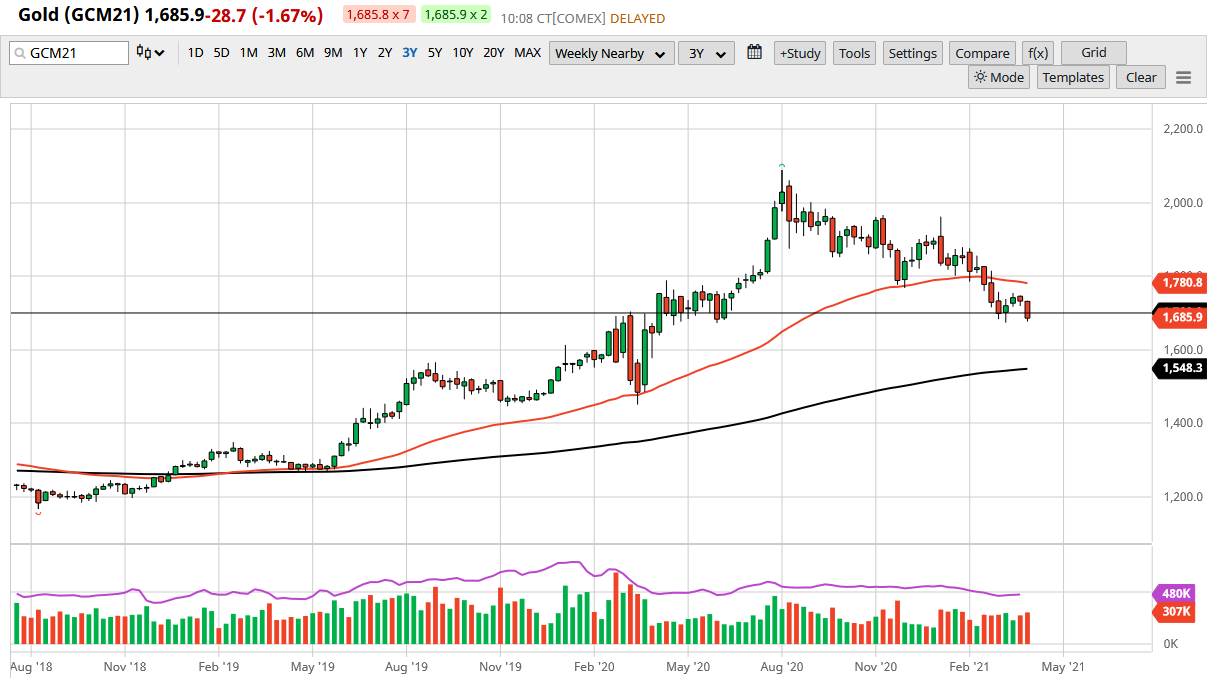

I do not see that changing in the short term, as markets are more than likely going to see the 10 year yield rise towards the 2% level, and I think that will break the back of gold. By the time we get to the end of the first week of April, we may have already made a “lower low” on the weekly chart, which for me opens up the possibility of a move all the way down to the $1600 level initially, and then after that a reach down towards the $1500 level where I think there is much more in the way of significant support. If that breaks down, this market is going to fall apart. I do not expect that to happen during the month of April though.

This has everything to do with the US dollar and yields in America, and very little to do with demand for gold. Gold markets do horrible when there is a real rate of return on bonds, and I think that will continue to be the case. Do not get me wrong, if there is a sign of strong real inflation, that could change things, but we are seemingly light years away from that happening. Since the highs in August, gold has lost 20%, and it looks like it is probably going to continue losing going forward. I also anticipate this having a negative effect on commodity currencies as well, so keep an eye on those markets also. Having said all of that, if the market takes out the $1775 level, we could have an attempt at a longer-term rally, but that needs cooperation from the bond market.