The gold markets have broken down a bit during the course of the trading session on Thursday after initially trying to rally. Most of this has been due to the bond markets and everything that is going on in that world. Jerome Powell gave a speech during the day in which he did not suggest that the Federal Reserve was willing to jump in and drive bond yields back down. That is toxic for gold, so we will have to see whether or not there is still more downward pressure.

Another thing that could cause major issues for this market is the fact that it is the jobs report coming out on Friday that will be the headline, and that of course has a major influence on the US dollar, which of course is the other side of this equation. If the US dollar continues to strengthen that will drive gold much lower. If we drop about another $15, I believe that the “trapdoor” opens up and we could see the market dropped a couple of hundred dollars, perhaps as low as $1500 an ounce.

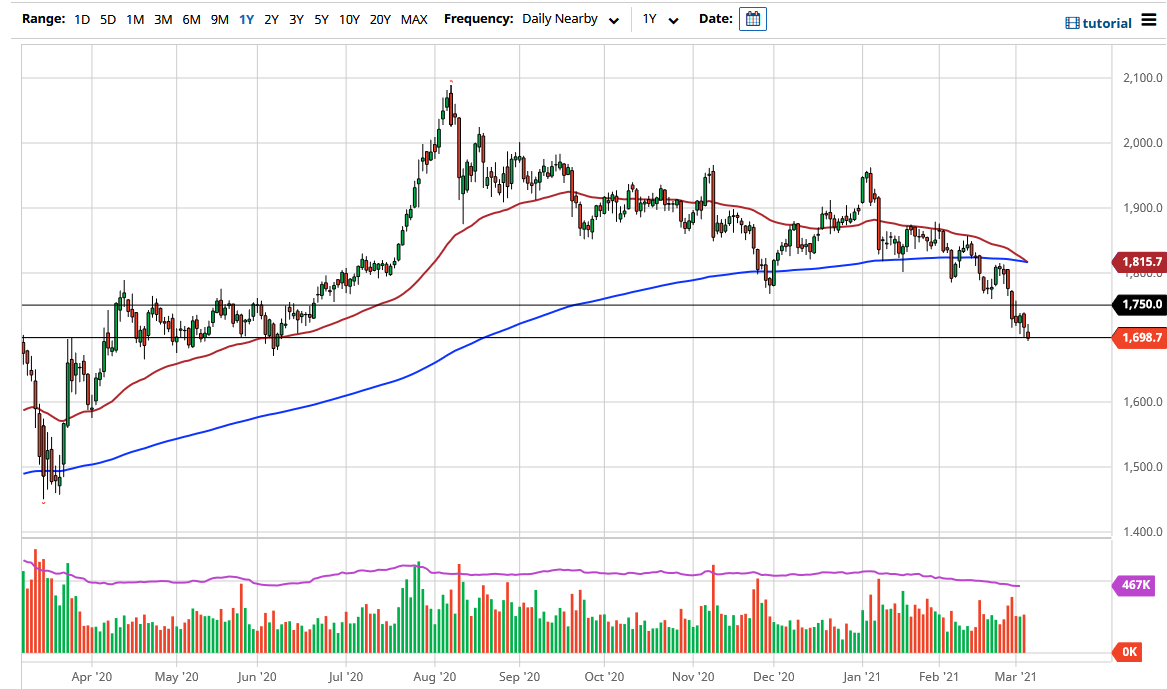

On the other hand, if we can see the gold market turn around and take out the $1750 to the upside, that could kick off significant buying. At that point we could go looking towards the 200 day EMA, which is currently at the $1815 level. Speaking of that level, it is also where we find the 50 day EMA, so we could see the so-called “death cross” come into play as well. While I am not a big fan of this sell signal, the reality is that it does capture a certain amount of attention, and that in and of itself will have people looking at the possibility of selling for a longer-term move.

It certainly looks as if gold is on its back foot, but one also have to keep in mind that there is still a little “band of support” just below the $1700 level that we have not quite cleared yet. Furthermore, the jobs number could change everything, but at this point it is pure speculation as to what happens as far as that is concerned. Quite often, by the end of the jobs number trading session, you have a huge unchanged candlestick. We will have to wait and see what happens next as far as that is concerned but it clearly looks as they have the real risk is to the downside, not the upside.