Gold markets have rallied a bit during the trading session on Wednesday to show a continuation of the overall consolidation that we have been in. At this point, I think that the market is probably going to continue to see sellers coming back into the market. After all, the gold markets are going to be inversely correlated to the idea of interest rates in America, which have been rising overall. When it is easier to clip coupons and collect that money instead of trying to pay for storage when it comes to gold.

As long as the treasury market selloff over the longer term, then it will continue to drive interest rates higher, making the US dollar much more attractive against most currencies, and metals. Furthermore, the real yield coming out of the markets over inflation means that investors can get paid, so it makes no sense to pile into gold.

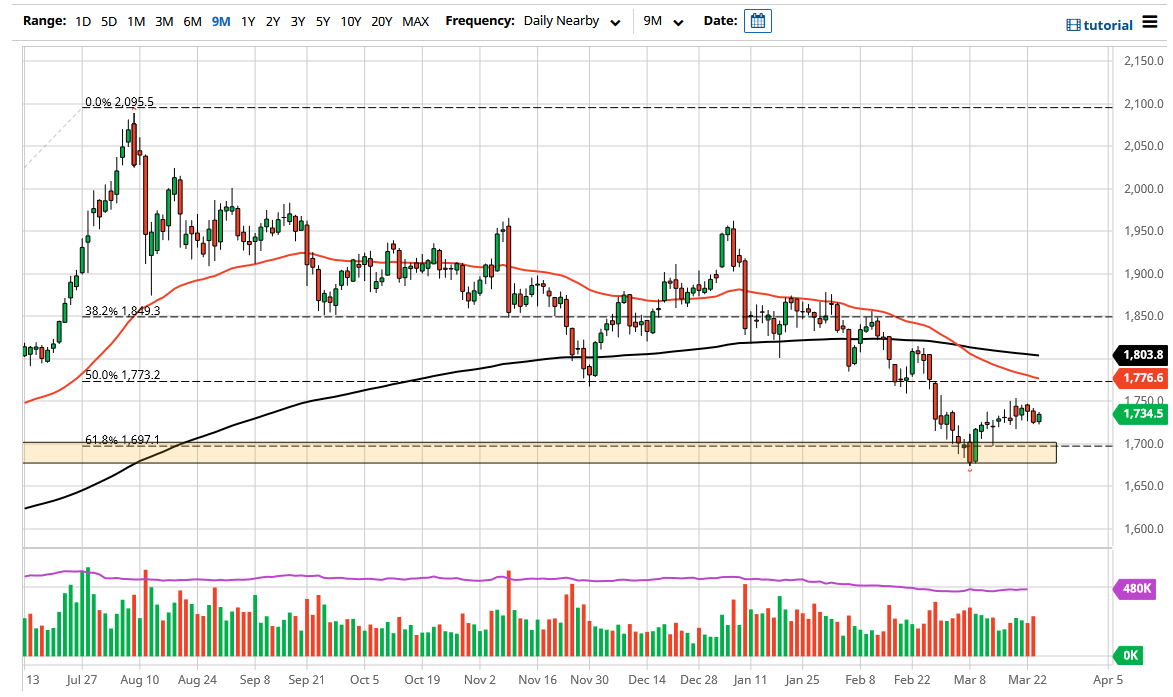

As long as yields rise, it does not bode well for gold as inflation is not taking off quite the way that people had thought. In other words, you are getting paid quite nicely for owning a bond via yields. However, if those markets do start to see falling yields, it is possible that we could see gold turnaround, with the $1700 level offering significant support. The 61.8% Fibonacci retracement level is sitting right in that area as well, so I think that is reason enough to suspect that there could be a little bit of support. However, we break down below the most recent lows, the market is likely to go looking towards the $1500 level. That is a large, round, psychologically significant figure, and I do think that buyers would come back in and perhaps hold onto gold for a bigger move.

On the other hand, the market was to turn around a break above the $1800 level, that would confirm a bit of a bottom as we could continue to go much higher. All things being equal, I think more than anything else we are going to see a lot of choppiness in this general vicinity. The choppiness in this market will probably get worse before it gets better, so regardless of how you choose to play it, you should do so with a relatively small position and build once it works in your favor.